When it comes to interest-rate hikes, it’s not quite over yet.

A quarterly uptick in a widely watched measure of wage inflation all but ensures the Federal Reserve Board will raise its benchmark federal-funds rate by a quarter of a point when officials sit down to meet this Tuesday and Wednesday.

The Employment Cost Index released by the Bureau of Labor Statistics Friday showed wages and salaries rising by 1.2% in the three-month period ended in March from the previous quarter.

“It was a larger and hotter print than last quarter and above consensus estimates,” says Jeff Schulze, investment strategist at Clearbridge Investments. “It’s the final nail in the coffin for another rate hike.”

Vanguard Group’s senior international economist Andrew Patterson says the rise in wages suggests that a 0.25-percentage-point rate hike in the funds rate from its current target of 4.75%-5% is “pretty locked in.”

While wages may be peaking on a year-over-year basis, the rise in the latest quarter shows they remain at higher levels than the Federal Reserve would prefer, says Schulze. He notes that the central bank pays closer attention to the direction of quarterly data as an indicator of current trends when setting monetary policy.

Also, the Fed’s favorite gauge of underlying inflation, the Personal Consumption Expenditures Price Index, excluding food and energy, tracked by the Bureau of Economic Analysis, rose 0.3% in March for the second straight month. It gained 4.6% from the year-ago period.

The higher inflation is beginning to hit the economy: Growth in the U.S. economy slowed considerably in the first quarter with gross domestic product rising at an annualized 1.1% rate compared with expectations of 2%.

According to the CME FedWatch Tool, which tracks bets on the direction of interest rates in the futures market, the odds of a quarter-point rate hike are 86% at the May meeting. The widely expected May rate increase would mark the 10th straight rate hike in the past year as the Fed tries to wrestle control of stubbornly high inflation.

What Data the Fed Will Be Watching:

- Monthly Job Openings and Labor Turnover Summary

- Core Consumer Price Index

- Bank Lending Activity

- Bank Deposit Stability

- Bank use of Federal Reserve Lending Facilities

Other factors that will influence the Fed’s decision will be Tuesday’s release of the monthly Job Openings and Labor Turnover Summary, or JOLTS, which provides a snapshot of the strength of the labor market, as well as the Fed-conducted Senior Loan Officer Opinion Survey on Bank Lending Practices—sometimes known as the SLOOS report—that measures the availability of credit.

The most recent JOLTS data showed the number of job openings compared with available workers fell in February to a ratio of 1.7 for each available worker from 2 to 1. While headed in the right direction, it continues to remain uncomfortably elevated.

“We would like to see that tick down closer to 1.2,” says Patterson of Vanguard.

Bank lending standards and credit conditions will also inform the Fed’s decision. The SLOOS report is scheduled to be released the week following the Fed meeting, but Fed officials will have access to the latest data. Bank lending has been tightening for much of the past year, and the recent turmoil in regional banks triggered by the mid-March collapse of Silicon Valley Bank and Signature Bank, in addition to ongoing woes at First Republic Bank FRC, has likely caused more of a pullback. Demand for credit has also dipped.

The Fed will also be looking at weekly bank data to determine if deposit outflows have stabilized as well as looking at the number of banks turning to the Fed’s lending facilities, typically a sign of stress.

Will the Fed Pause After May?

However, what happens at its June meeting and beyond is a matter of debate. About 70% of market participants expect the Fed to pause in June, according to CME FedWatch. Morningstar’s Preston Caldwell expects the Fed to pause its rate increase by summer and start lowering rates around the end of the year.

Clearbridge’s Schulze is also among those who think a pause will be in order, especially given the uncertainty surrounding the negotiations between the Biden administration and Congress to lift the debt-ceiling cap on government borrowings to pay expenses. Also, he points out, should the Fed raise rates by 0.25 percentage points this week, it will bring rates to the level the central bank has indicated is the terminal rate to achieve its goals for a balanced economy.

Given the Fed’s projections for unemployment to reach 4.5% by the end of this year, Schulze is forecasting a recession later this year, another reason to pause.

Citing the Sahm Rule, a Fed-tracked indicator named after former Federal Reserve economist Claudia Sahm, Schulze says an increase in the three-month unemployment rate of 0.5 percentage points or more from a low in the previous 12 months signals the start of a recession.

“The easy part of fighting inflation was bringing it from 9% to 5%,” says Schulze. “Now the hard part is getting it from 5% to 2%. A weaker labor market is the key to that.”

Vanguard’s Patterson, on the other hand, sees a recession coming later this year but also sees rate hikes continuing in the near term.

“There’s still a lot of work to be done,” says Patterson. “We see rate increases in June and after. The Fed will continue to focus on inflation and wages and rightly so. Our base case is for a recession in the second half of this year.”

While the market is pricing in rate cuts as early as September, Patterson says “rate cuts are a 2024 discussion.”

Events Scheduled for the Coming Week Include:

- Monday: SoFi Technologies SOFI report earnings.

- Tuesday: Advanced Micro Devices AMD, Pfizer PFE, Ford Motor F, and Uber Technologies UBER report earnings.

- Wednesday: Federal Open Market Committee meeting.

- Thursday: Apple AAPL, Paramount PARA, Marathon Oil MRO, and PG&E PCG report earnings.

- Friday: April employment report.

For the Trading Week Ended April 28:

- The Morningstar US Market Index rose 0.64%.

- The best-performing sectors were communication services, up 2.8%, and real estate, up 1.4%.

- The worst-performing sector was utilities, down 1.1%.

- Yields on 10-year U.S. Treasuries fell to 3.45% from 3.56%.

- West Texas Intermediate crude prices fell 1.4% to $76.78 per barrel.

- Of the 846 U.S.-listed companies covered by Morningstar, 404, or 48%, were up, and 442, or 52%, declined.

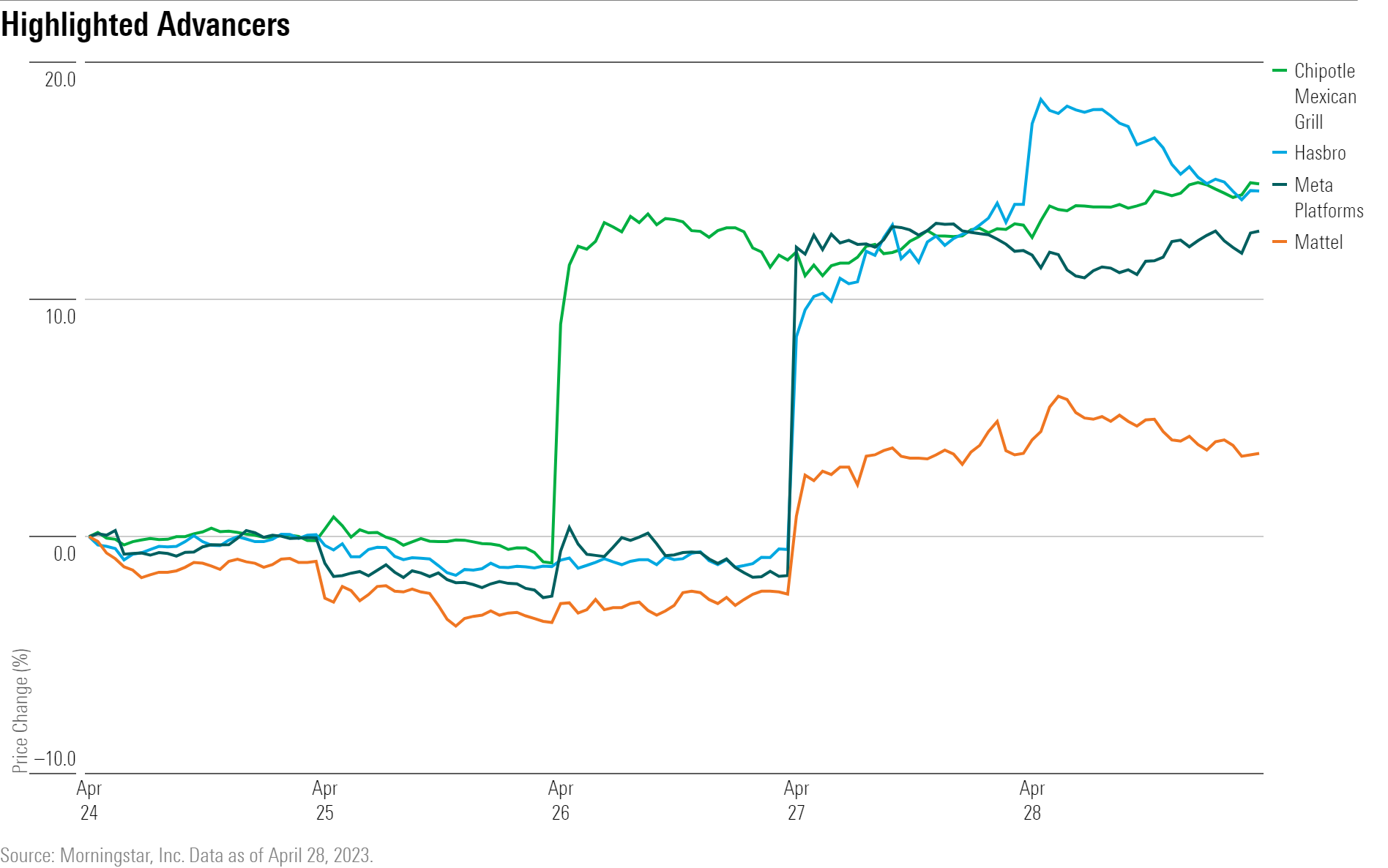

What Stocks Are Up?

Meta Platforms META stock rallied after the social-media company posted first-quarter results. The highlight of the firm’s results was Reels monetization, which contributed to Morningstar senior equity analyst Ali Mogharabi raising his fair value estimate to $278 per share from $260.

“With improvement in Reels impressions and ad prices, cannibalization of other ads on Instagram is likely to end this year or early in 2024, which should drive accelerating revenue growth. Reels has also helped increase time spent on Meta apps, which should further increase ad demand not just on Reels but also on Stories and Feed,” he says.

Toy-maker stocks Hasbro HAS and Mattel MAT rallied despite year-over-year declines in first-quarter sales. Sales for both companies were also better than expected FactSet consensus estimates.

An earnings beat from Chipotle Mexican Grill CMG led to a jump in its stock price. The firm posted earnings per share of $10.50, beating estimates of $8.95. The company also posted 11% growth in comparable store sales, “suggesting that despite double-digit price increases, the firm’s value proposition hasn’t yet outrun its core customer,” says Morningstar equity analyst Sean Dunlop. He expects to raise his $1,550 fair value estimate by a mid-single-digit percentage.

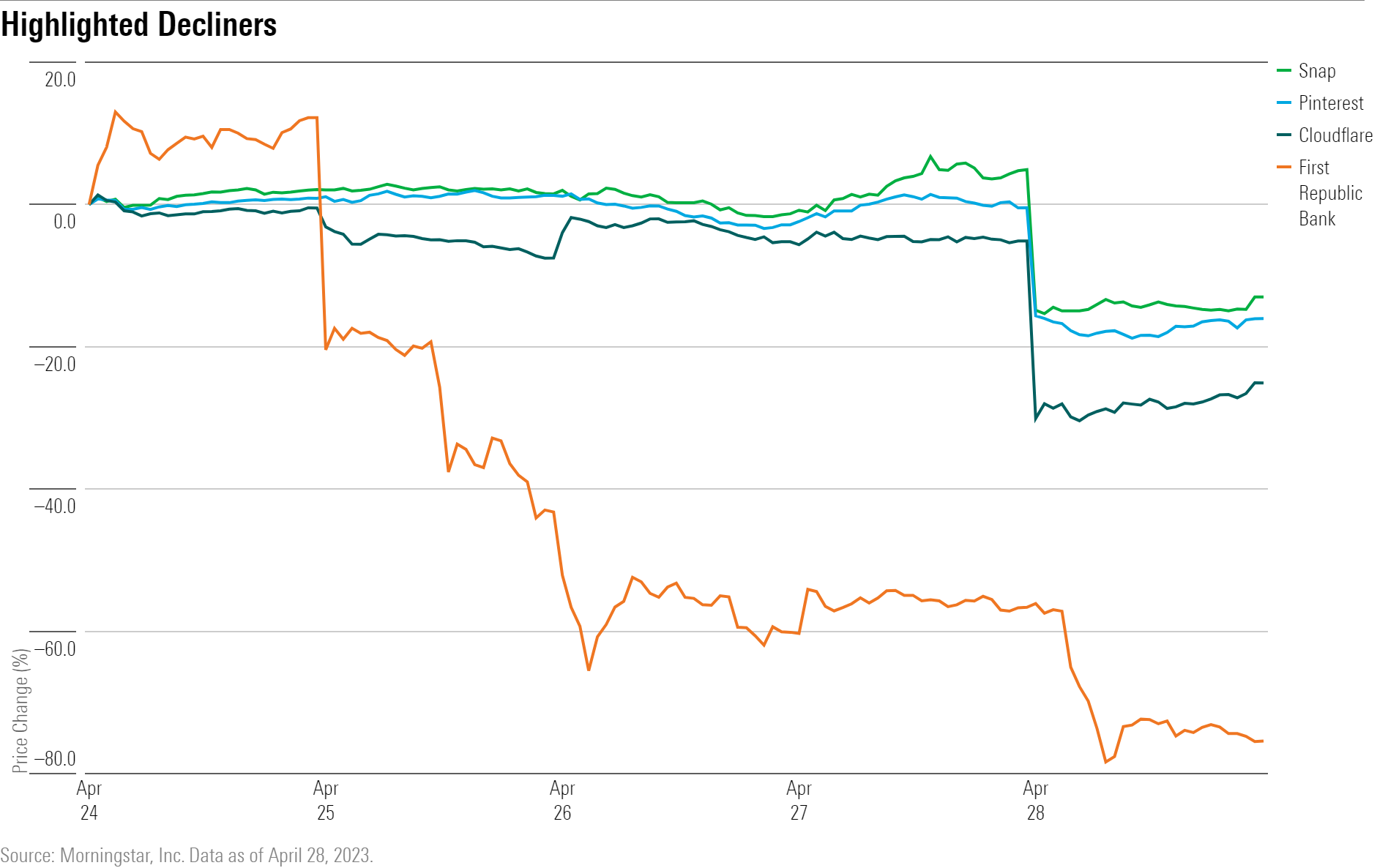

What Stocks Are Down?

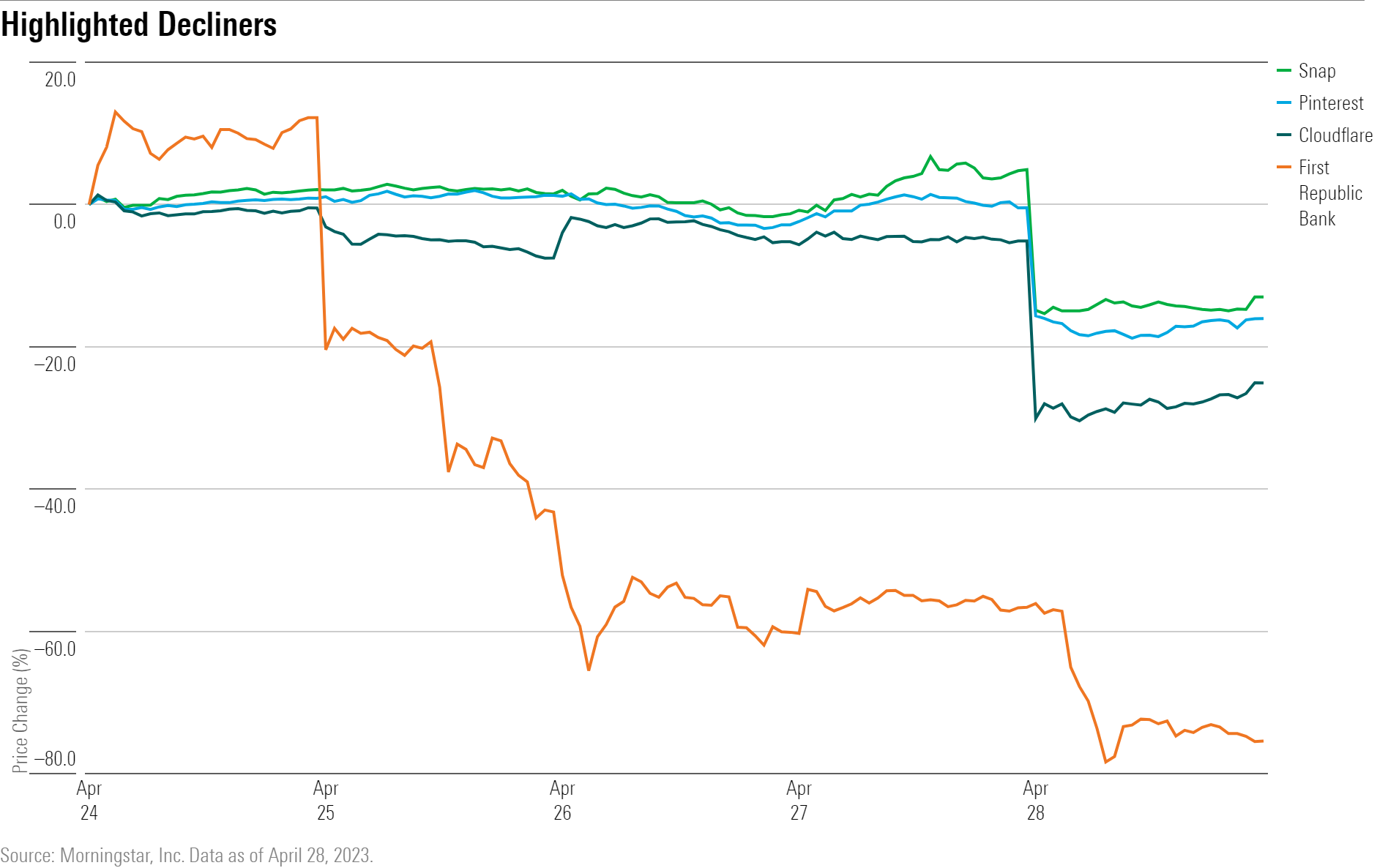

First Republic Bank (FRC) shares plunged after the firm showed a 40% decline to $104.5 billion in its deposit base during the first quarter, a level slightly worse than even the low end of Wall Street’s estimates. Morningstar strategist Eric Compton now values the bank with a zero fair value estimate.

Compton says that had the bank’s deposit base remained static, it could have held on for a few more quarters until interest rates fell enough for the bank to be profitable. However, he sees two key items that make that scenario unlikely.

“We think the implications of the recent earnings report from First Republic increases the likelihood that more depositors leave, which further shortens the time window for the bank to recover. And, secondly, we doubt that the regulators are willing to stand by and let First Republic completely unravel before shutting it down,” he says.

Cloudflare (NET) shares tumbled after the firm slashed its full 2023 sales guidance to $1.28 billion, down from a former midpoint of $1.36 billion. “We were surprised to hear of the sales execution challenges stemming from underperforming salespeople,” says Malik Ahmed Khan, Morningstar equity analyst. Still, he expects “Cloudflare to resolve these personnel-related challenges in the coming quarters and anticipate these issues will dissipate over time,” and he maintained his fair value estimate of $60 per share.

Shares of Snap (SNAP), developer of social-media app Snapchat, fell after the firm disappointed in user metrics. “While Snap’s daily average user count continued to grow impressively, up 15% to 383 million, monetization per user weakened year over year for the fourth consecutive quarter, down 19%,” says Morningstar’s Mogharabi.

Pinterest (PINS) stock also slid after the company disappointed investors with guidance that operating expenses were to grow by a low-teens percentage quarter-over-quarter. Second-quarter revenue was also guided to grow between 4% and 5%, around the same pace as the company’s previous two quarters.

Pinterest also announced a partnership with Amazon.com AMZN, which would place Amazon third-party ads on the platform. This “will make sales conversions much easier, as users will be taken to Amazon.com to purchase more easily. We think this will also increase interest from other retail ad networks such as Walmart Connect,” says Mogharabi.

Top Allocation Funds for Global, U.S., and Asia Exposure

Top Allocation Funds for Global, U.S., and Asia Exposure

What Caused 2023's 'Everything' Rally?

What Caused 2023's 'Everything' Rally?

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

.png) 2025 Morningstar Fund Awards Winners

2025 Morningstar Fund Awards Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends

.jpg)