Are your clothes embroidered by children? Is your phone made by a minority community that is being forced to work by the government in charge of their region? Or was your favourite movie shot in a persecuted people’s homeland?

These are questions that worry people on both ends of the political spectrum. In fact, forced labour, and specifically the treatment of the Uyghur people of the Xinjiang region of China, is about the only issue on which both pro- and anti-ESG (environmental, social, and governance) investors seem to agree.

Last month, we talked about the rise in anti-ESG shareholder proposals. We found that these disingenuously submitted proposals are usually filed by groups that oppose the work of “pro-ESG” investors, less to offer a constructive path to change and more to disrupt a movement that is gaining steam.

In most cases, the intent of the anti-ESG proposals is diametrically opposed to those of the pro-ESG proposals. The one issue on which both sides agree is the use of forced labour in China, where the minority, mostly Muslim, Uyghur community is persecuted. (One of the proposals that has been filed deals with the use of child labour in cobalt mining in the Democratic Republic of Congo, though it adds that the global cobalt supply chain is controlled by “Communist China.”)

Forced Labour in China: The Equalizing Issue?

The International Labour Organization and the Walk Free Foundation estimated that forced labour generates USD 150 billion in profits annually. “Modern slavery laws around the world—like in the EU, the US, UK, Canada, Australia--prohibit the use of forced labour in companies’ operations and supply chains, potentially leading to import bans,” says Morningstar’s Jackie Cook, director of stewardship in the Sustainalytics' Stewardship Services Team, which manages the ESG Voting Policy Overlay service.

New US legislation, the Uyghur Forced Labour Prevention Act, requires the U.S. government to develop a new enforcement strategy to strengthen the prohibition of the import of goods made through forced labor from the region into the United States, essentially banning imports unless an importer can prove that that the goods were not mined, produced or manufactured wholly or in part from forced labor. This act received bipartisan support in the U.S. More jurisdictions may follow, and Cook believes this will strengthen investor pressure on companies to conduct enhanced supply chain due-diligence.

Clearly, the forced labour issue has financial and business-related implications, and both sides of the ESG debate want answers on how companies are addressing these risks.

In mid-March 2022, As You Sow, the Sustainable Investment Institute, and Proxy Impact released the Proxy Preview 2022, a forecast of the upcoming proxy-voting season. (Learn more about what proxy voting is here.) "The field of proposals from politically conservative groups, chief among them the National Center for Public Policy Research, continues to focus heavily on social policy. It is joined this year by the National Legal and Policy Center. Resolutions from these and similarly minded proponents seek action that is the mirror image of what all the other proposals request, aside from doing business in China,” the report notes.

Issues being raised include the use of forced labour in the Xinjiang region, as well as requests for disclosures around the supply chain for many of these companies, especially where cotton is a part of the manufacturing process. The Xinjiang region produces 85% of the cotton in China, according to the Washington Post.

Companies Are Questioned About Activities in China, Including Forced Labour

Which resolutions are focused on forced labour in China?

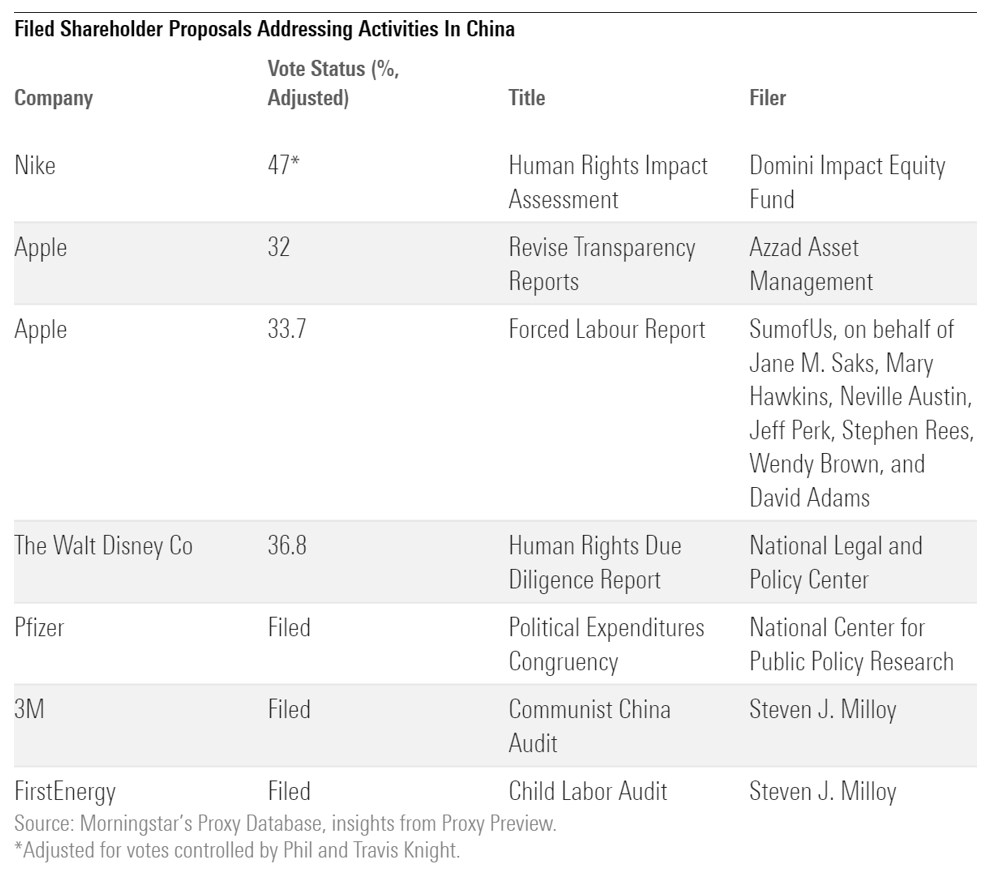

We looked at Morningstar’s Proxy database to identify shareholder proposals that addressed activities in China. We found seven proposals filed so far. As more companies engage (or not) with filers, and more shareholder proxy statements are filed and made public, this number could increase.

Of these, four have already been voted on: one at Nike NKE, two at Apple AAPL, and one at Disney DIS. All received more than 30% support from investors. Let’s look at these in some detail.

“Where new resolutions earn 30% support, boards are likely to take note. It means there's considerable investor momentum on the issue. Strong voting support strengthens engagements and may drive more resolution filing in subsequent proxy seasons,” explains Cook.

China-Focused Shareholder Proposals Get Over 30% Support

Apple

Apple had two proposals come to investors for vote--one requesting a transparency report, and the other requesting disclosures around forced labour in China.

The transparency proposal stated: “Apple’s transparency report for the first half of 2020 disclosed that it complied with all 46 requests from the Chinese government to remove 152 apps from the App Store. The report did not explain which apps were removed or for what reason. Shareholders are deeply concerned about a material failure in Apple’s transparency reporting that seemingly highlights a contradiction between Apple’s human rights policy and its actions regarding China and its occupied territories, which represent almost a third of Apple’s customer base. This poses significant legal, reputational, and financial risk to Apple and its shareholders.”

Thirty-two percent of shareholders supported this proposal.

The forced labour proposal asked that the company report on the extent to which Apple’s policies and procedures effectively protect workers in its supply chain from forced labour, including the extent to which Apple has identified suppliers and sub-suppliers that are at significant risk for forced labour violations, the number of suppliers against which Apple has taken corrective action owing to such violations, and the availability and use of grievance mechanisms to compensate affected workers. “It has been reported that at least nine companies in Apple’s supply chain participate in the government of China’s forced labour program. Reports suggest that Apple severed ties with Ofilm Group over allegations that it’s involved in that program. Following evidence since 2017 of millions of Uyghurs and other Turkic Muslims being forced into internment camps and related labour programs, the Parliaments of the UK and Canada and the US State Department recognized this as a genocide,” the supporting documents claim.

Among Apple shareholders, 33.7% supported this proposal.

Disney

The Disney shareholder resolution was filed by the National Legal and Policy Centre and asked that beginning in 2022, Disney report on the process of due diligence, if any, that the company undertakes in evaluating the human rights impacts of its business and associations with foreign entities, including foreign governments, their agencies, and private-sector intermediaries.

The impetus for this request came from that fact that the film credits for Disney’s 2020 live action film Mulan offered “special thanks” to eight Chinese government entities in Xinjiang province. Mulan was filmed in the Xinjiang region, where the Chinese government is persecuting the Uyghur people. “The credits also expressed thanks to the publicity department of CPC Xinjiang Uyghur Autonomy Region Committee, the Chinese Communist party’s propaganda agency in Xinjiang,” NLPC’s supporting statement said.

“Disney’s current human rights policies are largely focused on supply chain labour and human rights concerns about manufacturing of its licensed products, which both NLPC and SumOfUs, its counterpart on the other side of the political divide, find inadequate,” the 2022 Proxy Preview report noted.

Investors gave 36.8% support to the resolution.

Nike

In October 2021, shareholders at Nike asked for a human rights impact assessment of its cotton-sourcing practices, throughout the full supply chain.

“Recent events have increased human rights risks associated with cotton sourcing, a significant input in Nike's products. Unfortunately, the Company's current disclosures do not provide visibility on that level and efforts to engage the Company directly have not yielded meaningful dialogue. The lack of transparency on cotton sourcing also introduces challenges for investors seeking to fulfill their commitments to conduct robust human rights due diligence,” the supporting statement said.

Nike is majority-controlled by its co-founder Phil Knight, and his son Travis Knight, who, along with the holding companies and trusts they control, own more than 97% of outstanding Class A shares. If the votes of the Knight family are discounted, 47% of the shareholders of Nike supported this resolution.

Which Votes Are Still Pending?

Investors will be watching the ballots at Pfizer PFE, 3M MMM, and FirstEnergy FE.

At Pfizer, a proposal asks for a report on political spending, with the supporting statement saying, “Pfizer opposes the ‘use of all forms of forced, bonded, indentured, or compulsory labour,’ and recognizes that ‘the risks of modern slavery are particularly likely where our business partners rely upon migrant workers,’ but it supports many candidates who have failed to support legislation that would end Uyghur forced labour and who fuel the vulnerable migrant worker problem here by opposing sensible border security.”

At 3M, a proposal asks for a report on operations in China, with the supporting statement saying, “American companies doing business in Communist China is a controversial public policy issue. 3M has suppliers who operate in Communist China. Communist China is a well-known serial violator of human and political rights. Communist China may also possibly become a hostile adversary of the US for a variety of reasons.”

Finally, shareholders at FirstEnergy have requested that, beginning in 2022, the company report to shareholders on the extent to which its business plans with respect to electric vehicles and their charging stations may involve, rely, or depend on child labour outside the United States.

“Cobalt is an expensive metal used in electric car batteries. 59% of the global cobalt supply comes from the Democratic Republic of the Congo. Cobalt mining in the Congo is often done by children--as many as 40,000--working in brutal and unsafe conditions. A euphemism for these children is ‘informal workers’,” the supporting statement says, adding that the global cobalt supply change is now controlled by China, which is a known and egregious violator of human rights. “Shareholders have the right to know the extent to which, if any and intentionally or not, First Energy's business plans rely on or involve the direct or indirect exploitation of child labour and/or the violation of the human rights of child workers outside the United States,” it says.

.png)