An impasse between the U.S. and China over auditing and compliance standards hit the headlines again, as U.S. financial regulators are mulling potential delisting of Chinese firms that are unable to provide sufficient disclosure and access to U.S.-approved auditors.

The U.S. Senate passed a bill in June 2021 that would allow the U.S. Securities and Exchange Commission (SEC) to suspend companies from trading if they fail to submit their working papers to the Public Company Accounting Oversight Board (PCAOB) for three consecutive years (2021, 2022, and 2023). The rule also requires companies to declare whether they are owned or controlled by any foreign government.

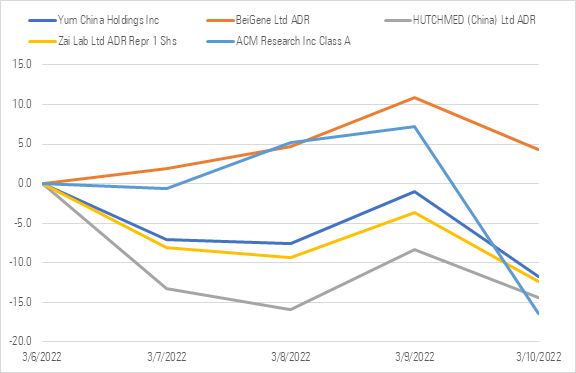

On Thursday, the U.S. regulator called out five companies that are in the middle of the accounting dispute - fast-food chain operator Yum China (YUMC), wafer processing solution provider ACM Research (ACMR), and bio-pharma firms BeiGene (BGNE), Zai Lab (ZLAB)and HutchMed (HCM), which is a biopharmaceutical producer arm under Hong Kong’s CK Hutchison (00001). The companies have been given time until the end of March to show proof to the authorities that they have complied with the audit requirements, or else they will have to delist from the New York bourse by 2024. Shares in these five companies tumbled on the news on Thursday.

More Names Might Make the List

Ivan Su, senior equity analyst at Morningstar, says: “These five firms were first to be included in the Provisional List because they were the first to publish annual reports for 2021. The SEC identifies what companies are subject to delisting as early as when the firm files its annual report. Therefore, we expect more Chinese ADRs to be included in the Provisional List over the next few weeks.”

For the delisting timeline, under the current provisions of HFCAA, forced delisting of Chinese ADRs can start in 2024, according to Su. “That said, the timeline can potentially move up by one year if the Accelerate Delisting Bill is signed into law. This bill passed Senate in June 2021 but has yet to be approved in the House. If this bill is signed into law, delisting can happen as soon as next year.”

The preparation of reliable and independent audit reports is fundamentally to safeguard the interests of investors and public interest, according to the PCAOB. The board has been voicing a lack of access in China and it turned more vocal after the fraud of Luckin Coffee (LKNCY). The largest coffee chain in China was found fabricating its sales records; this was a wake-up call for regulators to tighten oversight for non-compliant companies.

National Security Loopholes?

From the Chinese authorities’ perspective, the request for information may have crossed the line, triggering national security concerns. Chinese laws have long forbidden companies from handing audit working papers to foreign regulators on the grounds that they constitute “state secrets.”

However, given the imminent timeline of explanation on compliance and potential delisting, Su sees “a remote chance” that Chinese companies will be delisted from the U.S. stock exchanges because the two countries are actively working to resolve this current challenge.

“We started seeing signs of the U.S. and China working together to resolve auditing challenges,” he says, citing the discussion between two countries’ regulators in December. “Progress is getting made, evidenced by CSRC Vice Chairman’s comment on Jan. 29, 2022, which stated that ‘China and the United States were making progress in coordinating regulations governing Chinese companies listed in New York and there could be a ‘positive surprise’ by June or earlier.’”

Keep an Eye on Liquidity

Su also notes: “Most of the Chinese ADRs under Morningstar’s equity research coverage have a fungible dual listing in Hong Kong. That means, investors can convert their U.S. shares into shares listed on the Hong Kong bourse.”

However, risks may also be derived from the trading volume and liquidity issues that ensue. Su continues: “A majority of trading of these Chinese ADRs currently takes place in the U.S. For instance, more than 90% of the trading volume of Yum China comes from the U.S. bourses, so investors with large positions may have concerns regarding future liquidity.”

Not a New Concern

The audit impasse has been discussed over the past years as the U.S.-listed Luckin Coffee accounting scandal unfolded. Last year, the Chinese authorities initiated a probe on Didi Global and data security. Subsequently, the ride-hailing platform was voluntarily delisted from the U.S. board.

“The data collected by these companies are not even directly associated to national secrecy and seemingly unrelated to politics, too,” according to Chelsey Tam, Morningstar’s senior equity analyst covering the Chinese tech sector. She says, for example, that online recruitment company Boss Zhipin (BZ) and truck-hailing mobile app Full Truck Alliance (YMM) were also under investigation for suspected breaches of national security and cybersecurity laws. Both companies sought an initial public offering in New York in 2021.

.png)

.jpg)