Chinese stocks have extended the 2021 correction well into the new year, as investors remain fearful of some fast-growing sectors. Some anxiety comes as headlines on the ongoing regulatory clean-up by the Chinese government continue, even as sentiment has been further dented amid geopolitical uncertainties lead by the conflict between Russia and Ukraine. So far, the Morningstar China Index has registered a year-to-date loss of 14.5%.

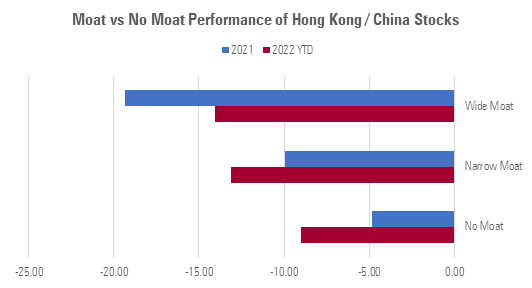

While the broader market is down, some of the moat-y names in our coverage universe have also dragged. Companies that Morningstar analysts award Economic Moat Ratings of ‘Wide’ and ‘Narrow’ have produced high losses in 2021 and in 2022 so far.

In the Short-Term, BATs Struggle…

Our coverage of Hong Kong and China stocks have registered year-to-date loss averages of 15%, versus a plunge of 20% in 2021. Wide Moat stocks Baidu Inc. (09888), Alibaba Group (09988), Tencent Holdings (00700) all had disappointing performances. In particular, Alibaba’s shares were in freefall – down 50% in 2021 and another 20% so far this year – bringing the country’s largest e-commerce player further below its IPO price.

Companies without an economic moat appeared to have suffered lesser pain, falling 9% year-to-date and 5% in 2021, on average.

…Long-Term, the Picture Changes

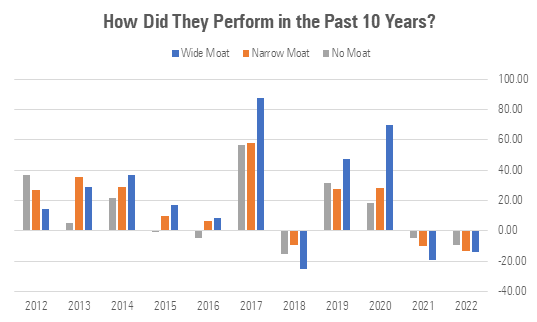

To put this into historical context, we dug into Morningstar Direct data over the past market cycle. The findings show that these short-term losses do not justify counting out shares in companies with the greatest competitive advantages and strong fundamentals.

As we look at it from a longer-term perspective of 10-year performance, a strong case emerges that moat-y stocks were outperformers against the wider universe. Between 2012 and 2021, stocks with wide economic moat outpaced the no-moat names in seven calendar years out of 10. The most prominent difference was spotted in 2020. As the coronavirus pandemic wreaked havoc on the world, companies with greater competitive advantages and quality endured the challenges better. Wide moat names delivered a hefty return of 70% on average. This also means wide-moat names outperformed the market by 40%.

Their no-moat peers outperformed the market only three times out of 10, and to a much smaller extent. Their less frequent outperformance was found in the year 2012, 2019, and 2021, on a scale ranging between 0.4% and 5.5%.

Another observation coming from the same chart is that, unlike no-moat names, moat-y companies have experienced corrections after a strong year of market returns. This finding leads us to look at a rolling window of different durations. Do outperformances in some years smoothen the bad years?

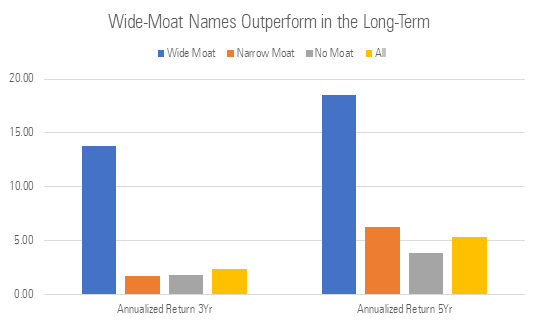

Over longer periods, wide-moat stocks have tended to be the best performers in the market, outpacing the broad market, narrow- and no-moat names by a large margin. The outperformance was even more visible in a five-year window. This has also reflected the resiliency and longevity of companies with better Morningstar moat ratings.

Wide-moat stocks are also “quality” stocks. Morningstar equity analysts make use of the moat rating to highlight companies with durable competitive advantages: things like brand loyalty, the network effect, cost advantages, and economies of scale. For the longevity part, our analysts believe that a company with a wide economic moat is positioned to fend off competitors for more than 20 years, while a company with a narrow moat rating holds advantages expected to support the company’s strong fundamentals over the next 10-20 years.

A Look at Some Moat-y Names

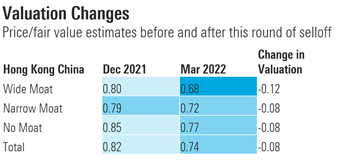

Into 2022, China and Hong Kong stocks had already been trading around 20% discount to their fair value estimates. Now, valuations on wide-moat stocks have come down even further, and that could present an opportunity.

Economic moat and moat trends are good measures, among other fundamental gauges like valuations, to capture stocks with longer-term investment value. Those with the greatest competitive advantages--generally outperform when inflation and interest rates are rising thanks to their greater ability to pass on price increases to customers and finance growth in their businesses without heavy borrowing. This is a critical feature where a moat-y company is more likely to outperform, especially facing under the upward pressure of inflation in the U.S. and higher financing rates.

In Hong Kong / China stock markets, there are multiple quality names, which our analysts continue to think their share prices are currently dislocated from their fair value estimates, in some cases like Tencent trading a discount as much as 54%. Here's the list:

4-and-5 Star Wide-Moat Stocks

|

Wide-Moat |

Price/fair value |

Morningstar Star Rating |

|

Tencent Holdings Ltd 00700 |

0.46 |

5 |

|

Alibaba Group Holding Ltd 09988 |

0.53 |

5 |

|

Yum China Holdings Inc YUMC |

0.54 |

5 |

|

Taiwan Semiconductor Manufacturing Co Ltd TSM |

0.56 |

5 |

|

JD.com Inc 09618 |

0.57 |

5 |

|

Hong Kong Exchanges and Clearing Ltd 00388 |

0.72 |

4 |

|

Baidu Inc 09888 |

0.74 |

4 |

.png)

.jpg)