Albert Einstein is reputed to have said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” (although we’re not sure he was the one who really said that.)

As an investor, making your money work for you is the best way to increase your wealth. And the wealth you will accumulate is the result of 2 things: how long you invest and the rate of return on your investment.

[You will also need psychological qualities to make the whole thing work, such as being patient, disciplined, knowing the value of things, and being able to act decisively on your own reasoning (and not on the opinion of others) when the odds are in your favour]

Doing the Math

Why is compound interest so “magical”? The simple answer is: “Because it’s reinvested”. Compound interest is, simply put, interest on interest.

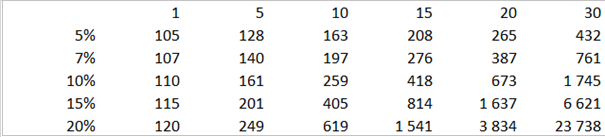

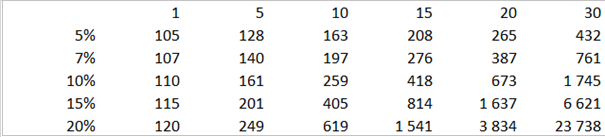

Here’s an example. Assume you invest $100. The following table shows how much return you’d get over different lengths of time, and at varying rates of return.

Exhibit 1: The Power of Compounding

Source : Author’s Calculations

If you invest $100 at 5% over 5 years, you get $128, but if you wait 10 years, that amount rises to $163. The longer you wait, the more you make! Of course, this goes even higher if you can get a higher return.

For example, if you can find an investment that returns 15% for 10 years, you multiply your money by a factor 4. If you wait for 20 years and still earn 15% a year (which is a lot), you get 16 times your money back.

20% seems like a very high unachievable return. Actually, it’s pretty rare, reserved to the most talented investors, such as Warren Buffett (the annual return of per-share market value of Berkshire Hathaway has been 20% per annum, over 55 years…).

Two Factors to Remember

If you want to accumulate wealth, you will need to start as early as possible and then focus on the best prospective return you can find.

The second factor is obviously the most difficult to get, because it depends on careful study of key elements such as the price you pay for the assets in which you invest, and their intrinsic qualities.

For instance, if you want to invest your money in stocks, you will need to select individual companies that boast high quality, and that trade at cheap valuation.

High quality companies are companies that have a strong competitive position in their market, have growth in their industry, generate high return on capital and growing free cash-flow, a strong balance sheet, and are managed by competent people.

Cheap valuation is also not an element you control. It’s usually the reflection of other people’s opinion, aka “Mr. Market”, that sometimes agrees to pay a lot for a company and at other times is willing to sell at a huge discount (per Benjamin Graham’s real quote in his must read book The Intelligent Investor or those quotes from Warren Buffett in his 1987 letter to shareholders).

But if you’re patient enough and know which companies/assets you want to buy, you just have to be patient and wait for the market to provide the opportunity to buy something you like at a fair price.

Then you will just have to stick to your guns and wait for other opportunities to come along.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To view this article, become a Morningstar Member.

Register For Free

How Can I Get Better With Money in 2024?

How Can I Get Better With Money in 2024?

10 Global Blue-Chip Stocks For The Long Term

10 Global Blue-Chip Stocks For The Long Term

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

.png) 2025 Morningstar Fund Awards Winners

2025 Morningstar Fund Awards Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends