While there's certainly nothing wrong with investing in micro-cap companies, the risks are real in one of the least researched segments of the market. The stocks are too small, new or speculative to be on the radar of most researchers. There are considerable challenges in understanding, monitoring and accounting for the risks these companies pose in the early stages of development.

In this article, we'll draw the curtain back on micro-caps, their allure and their risks.

What are Micro-Caps?

What constitutes a micro-cap stock will vary between markets. Safe to say that it is the smallest end of the market by market capitalization, typically under $250 million.

In general, a micro-cap fund manager will invest a large proportion of their portfolio at the very small end of the market.

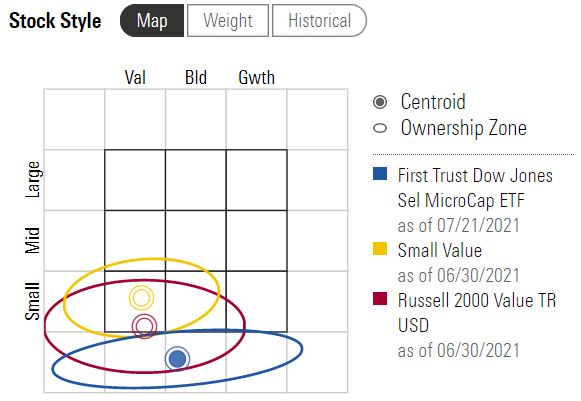

First Trust Dow Jones Sel MicroCap ETF (FDM)

Portfolio as at 30/06/2021

Source: Morningstar.ca

The Appeal

Obscurity is the main attraction in the micro-cap space. Micro-caps are an under-researched segment of the market. These stocks are either too small, too new, or indeed too speculative to be on the radar of many stockbrokers or institutional investors. Skilled micro-cap investors try to identify the undiscovered gems with the potential to grow earnings and migrate upwards towards smalls caps, or beyond.

For example, Canadian e-commerce giant Shopify (SHOP) started as a small snowboard equipment website. When its founders were unsatisfied with options for online stores they decided to build their own platform and tapped into a business model that would revolutionize the online retail environment – and reward portfolio managers that picked it up early.

Successfully uncovering these opportunities early on takes considerable time and effort. As Morningstar analysts explain:

"Micro-caps with nascent business models often have scant financial histories and unproven management, and they operate in rapidly evolving industries. While the rewards can be significant, the research effort to understand, monitor, and account for the risks is commensurate."

"The biggest risks lie around management, cash flow, and liquidity. Early-stage micro-caps with immature business models can be cash hungry, and reliant on regular capital raisings to fund growth."

In the event of a correction, analysts note that equity market liquidity can dry up quickly, leaving micro-caps vulnerable. In simple terms, this refers to how quickly shares can be bought or sold without impacting the price.

"For investors, the lack of liquidity can also mean difficulty exiting positions during times of market stress. During the financial crisis, small and micro-cap stocks suffered badly as cheap credit became scarce, liquidity dried up and losses were amplified."

While short-term gains can be considerable, investors must be prepared to weather extreme levels of volatility – or wild swings in the share price. Along with greater growth prospects, there is also a greater chance of failure. It's as profitable to avoid the failures as it is to pick the successes.

Micro-Cap Funds

Prefer to hand over the responsibility of picking winners to a portfolio manager? Morningstar fund analysts caution that while micro-caps have been a highly lucrative place for investors in the current market, the outsized returns on offer carry considerable risks.

Capacity also becomes an issue with small and micro-cap funds. "As funds gather assets and grow, their ability to move nimbly in and out of meaningful positions without adversely affecting the stock price becomes difficult," analysts say.

Morningstar recommends approaching strategies with care, and at most, considering a satellite allocation within a broadly diversified portfolio. Here, you might categorize 80 percent of your overall portfolio as the "core" and the remaining 20 percent as the "satellite". The satellite portion of the portfolio is where to express your tactical views on the market.

Get Active

Morningstar analysts recommend active strategies over passive index funds in this space noting that ETFs are not suitable for every asset class. Former passive strategies strategist Samuel Lee says:

- ETFs work best when their underlying holdings trade in efficient, deep, and liquid markets. The micro-cap market is none of those. Micro-caps can go for days, weeks, or months without trading a single share. When they mechanically buy and sell even small share lots into a relatively illiquid market, they can affect prices. Market impact costs undoubtedly play a significant role in diminishing micro-cap ETF performance.

- Front running also hurts micro-cap ETFs. Indexes are "stupid" in that they broadcast far in advance when and what they're going to buy and sell. Clever traders can trade shares in anticipation of these changes and pocket profits at the expense of indexed money. Front runners barely budge large-cap indexes such as the S&P 500 because arbitrageurs do a good job keeping stocks in line with fair value, but they can really hurt micro-cap indexers.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To view this article, become a Morningstar Member.

Register For Free

How to Invest on a Tight Budget

How to Invest on a Tight Budget

It’s Time to Start Underweighting Technology

It’s Time to Start Underweighting Technology

10 Reasons Why Japan Can Have a Great 2024

10 Reasons Why Japan Can Have a Great 2024

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

.png) 2025 Morningstar Fund Awards Winners

2025 Morningstar Fund Awards Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends