While speculative excess in the market has driven many of these stocks far beyond our fair value estimates, there are still several stocks we think are attractive for long-term investors.

What is Disruptive Technology Anyway?

The term disruptive technology is wide-ranging, but the key tenets are that:

• It encompasses situations which are more transformative than evolutionary, and in which it revolutionises the way business activities are conducted.

• In addition to providing economic value to the innovators, disruptive technology can affect an entire economic chain ranging from suppliers to end customers.

• In our view, disruptive technologies are not confined to just the technology industry, but anywhere in the economy that would derive enhanced economic value from innovation.

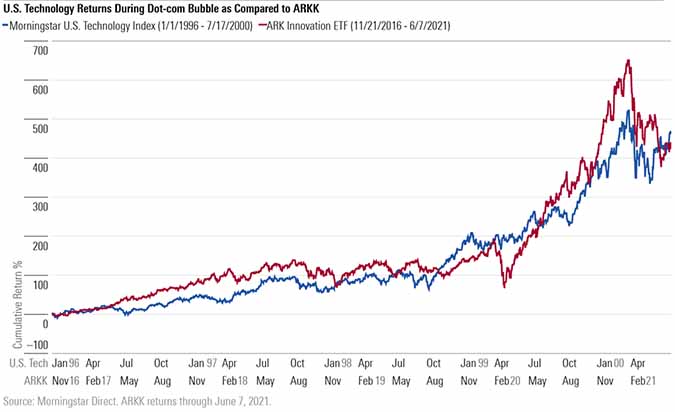

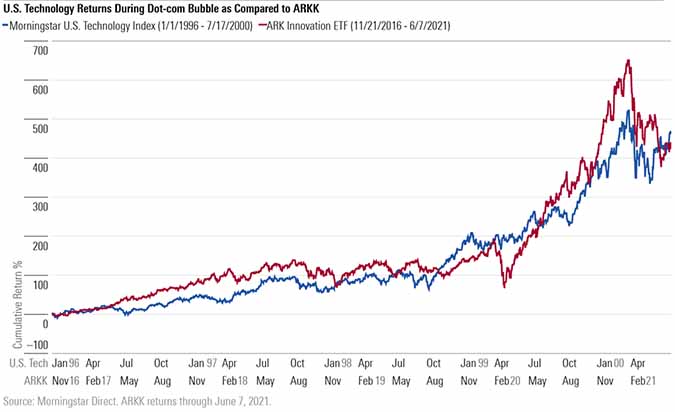

The 1990s dot-com boom was fueled by singular focus on the advent of the Internet and its possibilities. Many of the Internet stocks were hardly more than a grandiose idea with little in the way of a business proposal--much less a plan to profitability.

Today, instead of being limited to a narrow scope on the Internet, companies focused on disruptive technologies are spread throughout the entire economy and are targeting new ways to revolutionise numerous industries and sectors. While many of these companies are still within their early-stage development and product monetisation, they generally have a greater focus on achieving near-term profitability than the dot-com stocks did.

Why the Current Focus on Disruptive Technologies?

A lot of it has been driven by the coronavirus pandemic, which hasn’t so much formulated a new way of life as it has accelerated many economic and social trends which were already in place. Our previous series has looked at how to profit from disruption.

For example, shutdowns and social distancing drove rapid acceptance of working from home, online education, and e-commerce. Among other advances, the healthcare community employed big data analysis to model the progression of the virus and utilized new technologies to develop, test, and roll out vaccines in record time.

Consider: Teladoc Health (TDOC) is a virtual health provider that serves patients across all communication mediums; Palantir (PLTR) allows clients to manage and analyze large, disparate data sets; and in support of the work-from-home environment, DocuSign (DOCU) enables users to automate and provide legally binding contracts from any device.

How Does Morningstar Identify Disruptive Tech?

Morningstar’s equity research analysts review each of their companies to identify those that not only may be a direct developer of key technological advancements, but also those companies that stand to be indirect beneficiaries. Those companies are then reviewed to determine which will derive additional economic earnings growth from heightened revenue growth, greater cost savings, and/or enhanced productivity.

We have broken down disruptive technology’s key themes into nine different classifications:

1. Big data and analytics: Capability to utilise artificial intelligence to analyze large, complex and disparate data sets.

2. Bioinformatics: Science of collecting and analyzing complex biological data.

3. Energy & environmental systems: Wide-ranging field encompassing alternative or renewable energy sources and storage, to pollution control and mitigation.

4. Financial services: Broad array of services tied to nontraditional funding, banking, and crypto currencies.

5. Medicine & neuroscience: Advancement of new medicines as well as neurochemistry and experimental psychology that deals with the structure or function of the brain and nervous system.

6. Nanotechnology: Science that deals with dimensions of less than 100 nanometers, especially manipulation of individual molecules and atoms.

7. Networks and computer systems: Increase in connectivity and enhanced productivity.

8. Robotics: Design and application of robotics to enhance productivity.

9. 3D printing: Constructing an object from a three-dimension model by layering successive layers of materials.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To view this article, become a Morningstar Member.

Register For Free

10 Most Popular Stocks, Funds, and ETFs of 2023

10 Most Popular Stocks, Funds, and ETFs of 2023

These 3 ETFs Hold High-Quality Stocks

These 3 ETFs Hold High-Quality Stocks

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

.png) 2025 Morningstar Fund Awards Winners

2025 Morningstar Fund Awards Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends