Sharp declines among SPACs and electric vehicle stocks may herald a broader asset market correction, legendary investor Jeremy Grantham told the Morningstar Investment Conference in Australia last week.

The long-time bear, and co-founder of GMO Asset Management, used the dotcom bubble as an illustration of how markets tend to deflate in stages as what he sees as “pessimism termites” spread.

According to Grantham’s chronology of events, first, they came for the “crazies” – the Pets.com of the world. Then they came for the growth stocks, then the giants like Cisco. And finally, they came for the broader market.

He sees the beginnings of a similar pattern today.

“This time we see that the super crazies are anything to do with electrification and electric vehicles, Tesla is the king of that group, and the SPACS,” Grantham said during an interview with Morningstar chief executive Kunal Kapoor.

“The intersection of SPACS, EVs and batteries, was perhaps the most outstanding degree of exaggerated enthusiasm, and now the SPAC index is down 30%. The SPACS peaked in January, the NASDAQ peaked in February, and maybe in a few months, the termites will get to the rest of the market,” he added later.

A SPAC, or special acquisitions company, operates like a shell company, established by investors to raise money through an initial public offering to eventually acquire another company.

In October 1929, “flaky” stocks were already down for the year the day before the crash that signalled the beginning of the Great Depression. “When the high beta stuff starts to underperform, that’s when you want to watch out,” Grantham said.

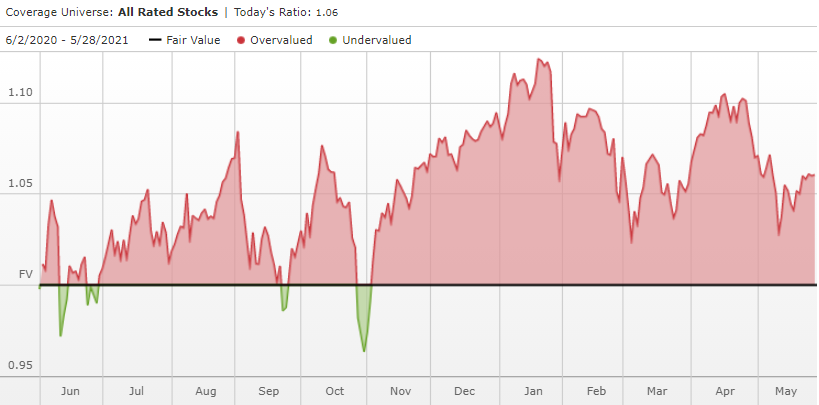

The Morningstar US Market Fair Value, which measures how overvalued the median stock in the coverage universe is, sat at 1.06 at the end of May. The higher it rises above 1.00, the more the median stock is overvalued. By this metric, the market has been overvalued year to date.

US stocks have been overvalued this year, according to Morningstar

Source: Morningstar

Grantham argues investors aren’t good at identifying the “pin” that pops the bubble. The reality is usually far more prosaic, he says. “It won’t take a thoroughly bad economy to start bringing this market down. It will take a perfectly good economy and a perfectly optimistic outlook, but one that is a little less than it used to be a week ago, a month ago.”

Grantham, who co-founded asset manager GMO in 1977, has made his name warning about asset price bubbles. His track record spans three decades, from the Japanese real-estate bubble of the 1980s, to the dotcom bubble of the 90s, and the 2008 global financial crisis of the noughties.

Watch emerging markets and commodities, avoid chemicals

Despite US equities being “heroically overpriced”, there are still opportunities to be found among value stocks in emerging markets, according to Grantham.

Separately he warned investors about the “underestimated shocks” awaiting the chemical, plastics, and pesticide industries over the toxicity of their products.

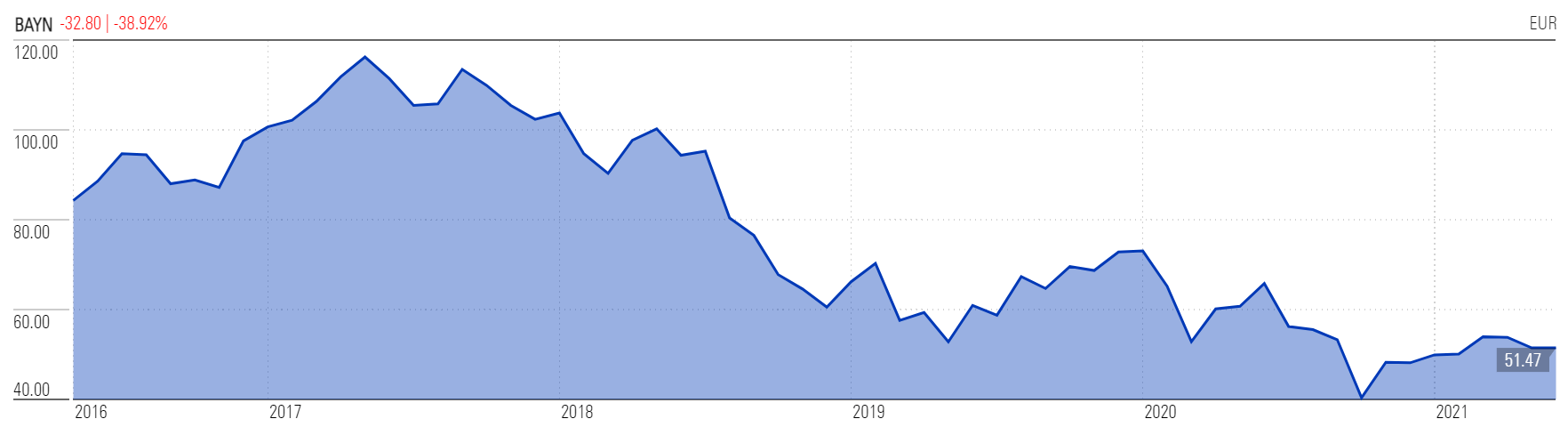

“Bayer has lost the entire value of Monsanto from its stock price. And its only one of the three big chemical companies.”

In 2016 Bayer (BAYN) bought Monsanto, maker of the pesticide Roundup. Four years later, in 2020, Bayer agreed to spend up to $15.87 billion to settle lawsuits alleging the product causes cancer.

Bayer’s long decline (Price since day Bayer announced intention to buy Monsanto)

Source: Morningstar Direct

Grantham is bullish on long-term commodity prices, arguing that there has been a “paradigm shift” after a 100-year period where falling prices were the norm.

“There's no way copper will not rise hugely from here because of the electrification of everything. And that goes for cobalt and lithium,” he said.

Big Oil was a ‘merchant of doubt’

Grantham, a long-time advocate for action on climate change, took aim at the oil industry, comparing it to Big Tobacco, in the way it has used what he sees as a decades-long campaign of “political propaganda” to confuse the issue of global warming.

“It cost the world as much as 10 years of progress on climate change action.

“This is absolutely a threat to our existence as a stable global society.”

Investors who ignore the environmental side of ESG are exposing themselves to the “biggest industry loss of value” in history, says Grantham. The oil industry has already fallen from 23 per cent of the S&P 500 in 1982, to 10 per cent a decade ago, and only about 3 per cent today.

His comments come as climate activists won at least two seats on the board of Exxon Mobil (XOM) last week, and a Dutch court ordered Shell to slash its greenhouse gas emissions by 45 per cent by 2030 from 2019 levels.

Grantham recommends buying into climate change or funds that prioritise environmental, social and governance benchmarks as a way for individual investors to make a difference.

But whatever investors do choose to buy, Grantham urges caution, warning: “The higher you go, the longer and greater the fall.”

.png)