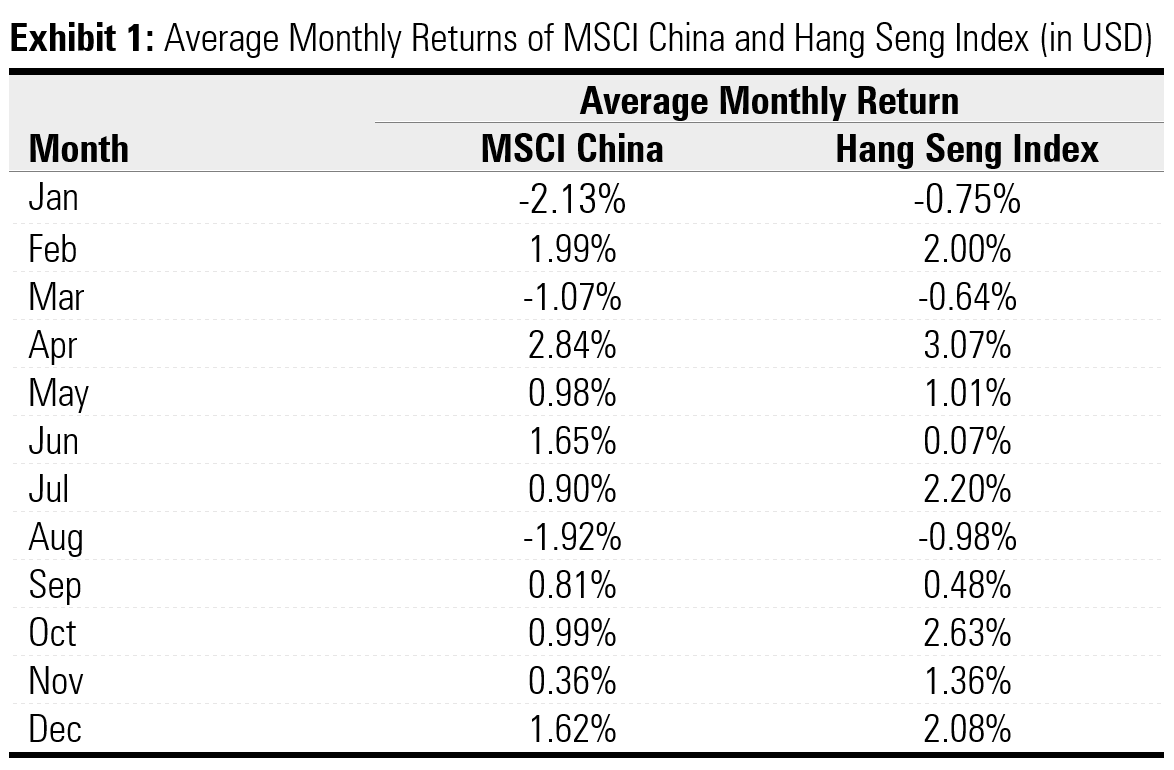

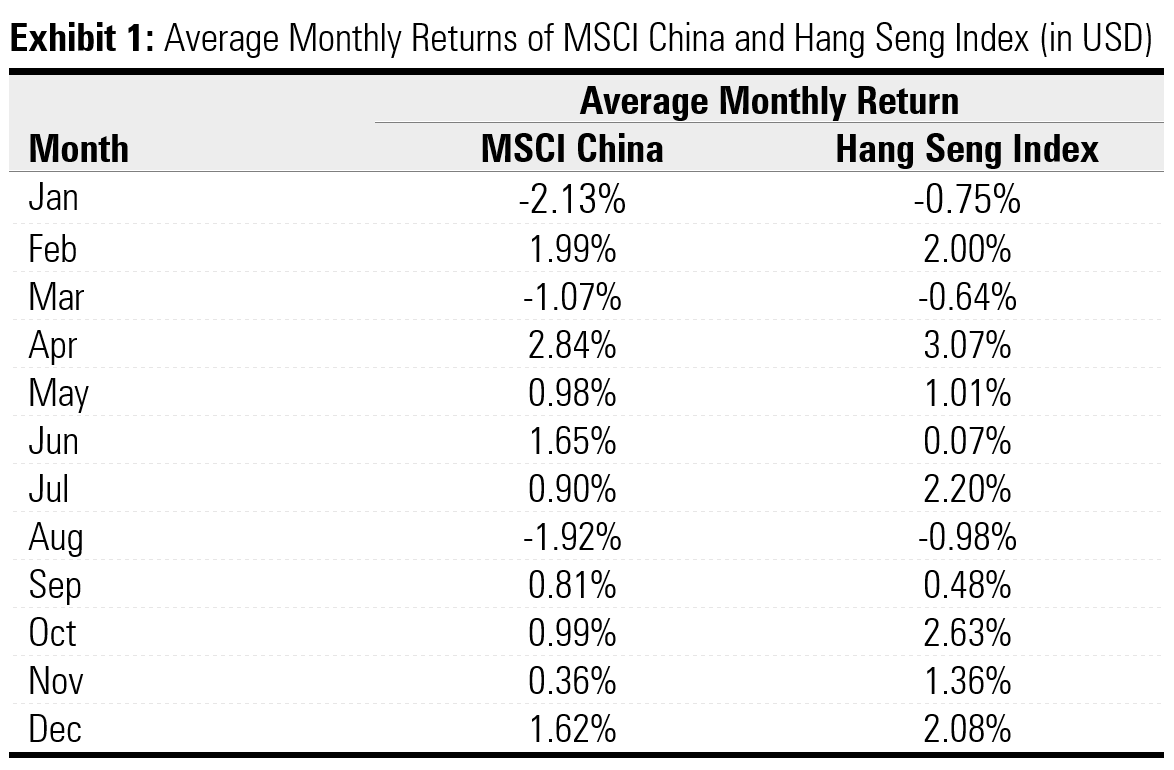

Experimenting with his approach in Asia, we picked two widely-tracked benchmarks – MSCI China and the Hang Seng Index – to this test if investors could dodge the ‘downtime’ between May and November, and gain on a short, medium and long-term basis, i.e. one month, one year and multiyear periods.

- source: Morningstar Direct, Author’s calculations. Time period: January 1993 to December 2019.

Between the months of May and October (both inclusive), on average over the past 27 years, the market tends to dip lower only in August. Apart from these months, January and March also recorded a negative average return. The other nine months, in contrast, returned positively.

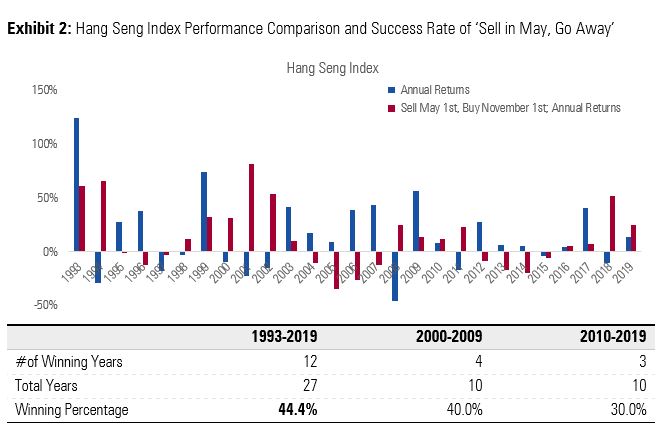

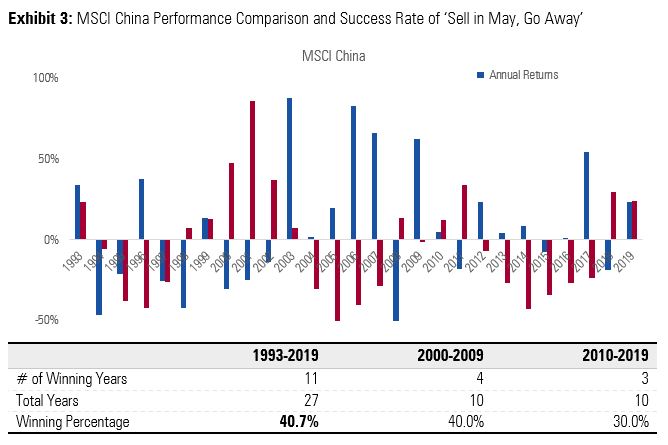

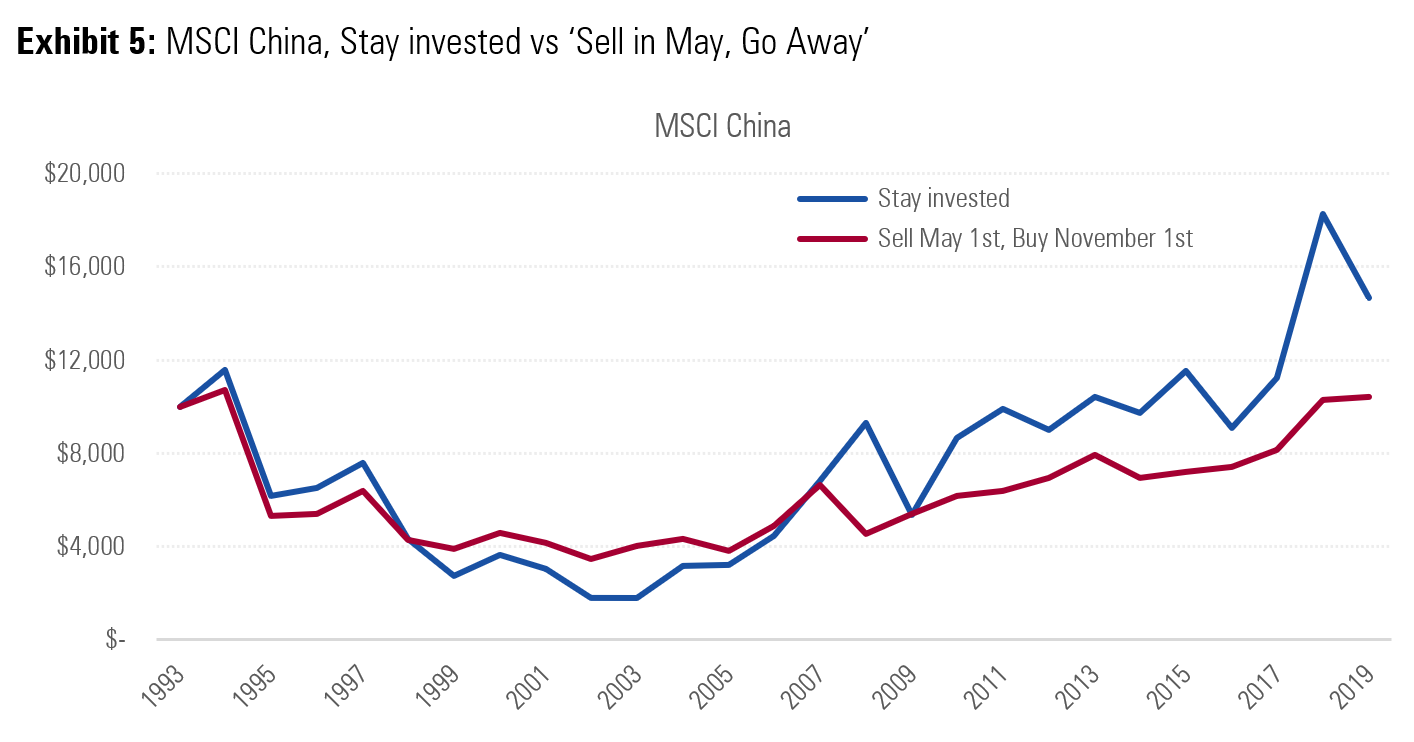

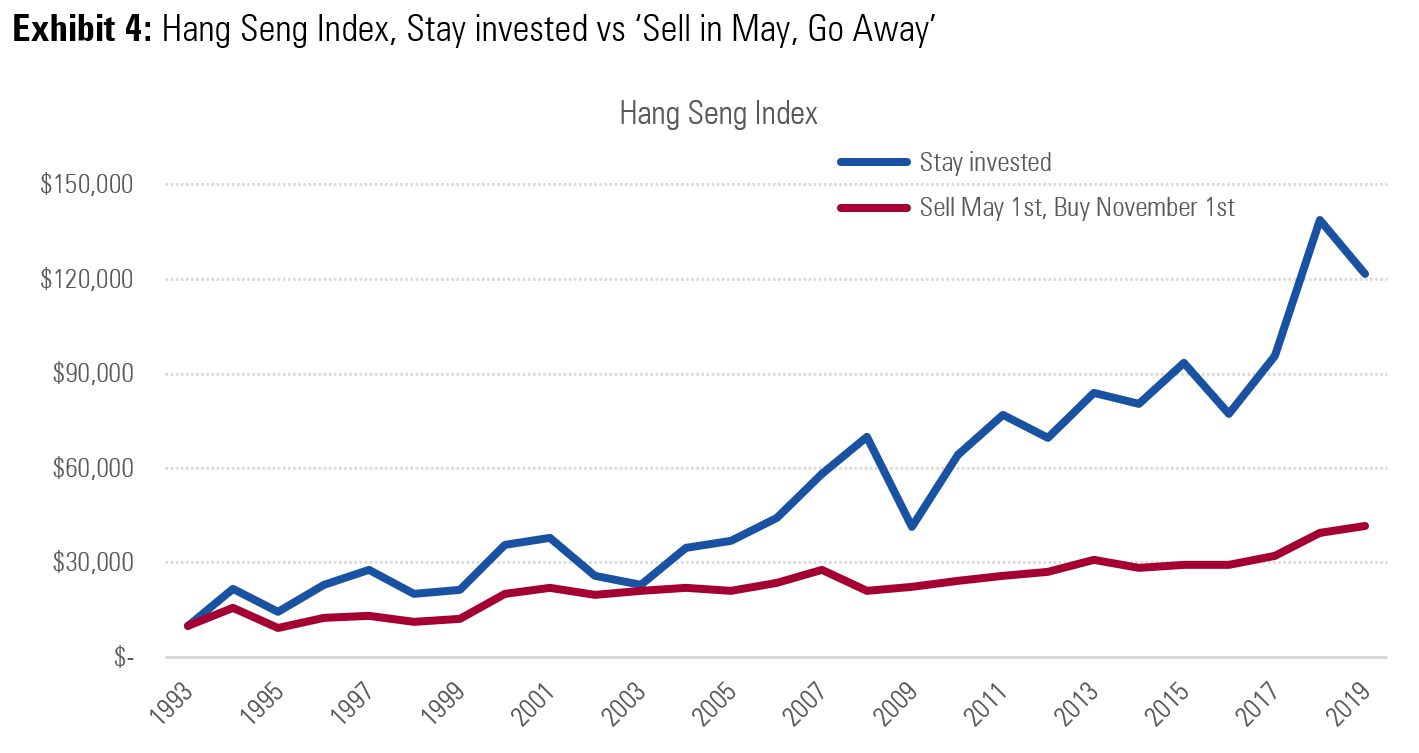

The illustration below is to display what would have happened on a yearly basis if an investor were to go to cash at the end of May and then buy back into the market on November 1st (Between May and October inclusive, the aggregate portfolio worth stays the same as April and resumes compounding at the rate from November for each calendar year).

Arguably, the Sell May 1st, Buy November 1st mechanism is the most beneficial through volatile times. Looking at charts for both MSCI China and Hang Seng Index, one can spot that some winning years for the ‘Sell in May’ strategy coincidently land at the years of regional or global financial market routs. The Asian Financial Crisis started in July 1997 and lingered through 1998, Dot-Com Bubble in 2000-2001, Global Financial Crisis in 2008, US-China trade disputes and geopolitics between 2018 and 2019.

That said, not surprisingly, the cashing-out strategy in the middle of year could not capture the rebound that closely follows the crises – full year returns outperform by a large margin in 2003 (SARS outbreak that was quickly tamed), and post-GFC in 2009, for instance.

- source: Morningstar Direct, Author’s calculations.

If we were to look at the number of times this strategy beat the index, there were 12 and 11calendar years where the “Sell in May, Go Away” strategy performed better than staying invested for Hang Seng Index and MSCI China respectively. That figure stays more or less consistent within each decade in isolation. Regardless of which decade we look at, the strategy does not do the investor any favours.

At a first glance, ‘Go Away’ strategy makes some large relative gains when the overall market was experiencing a hard time and even achieved a winning streak of three years (2000-2002). Looking in details, the strategy often underperformed the index in somewhat similar magnitude, and in many occasions in absolute terms (Negative returns for 15 out of 27 years).

- source: Morningstar Direct, Author’s calculations.

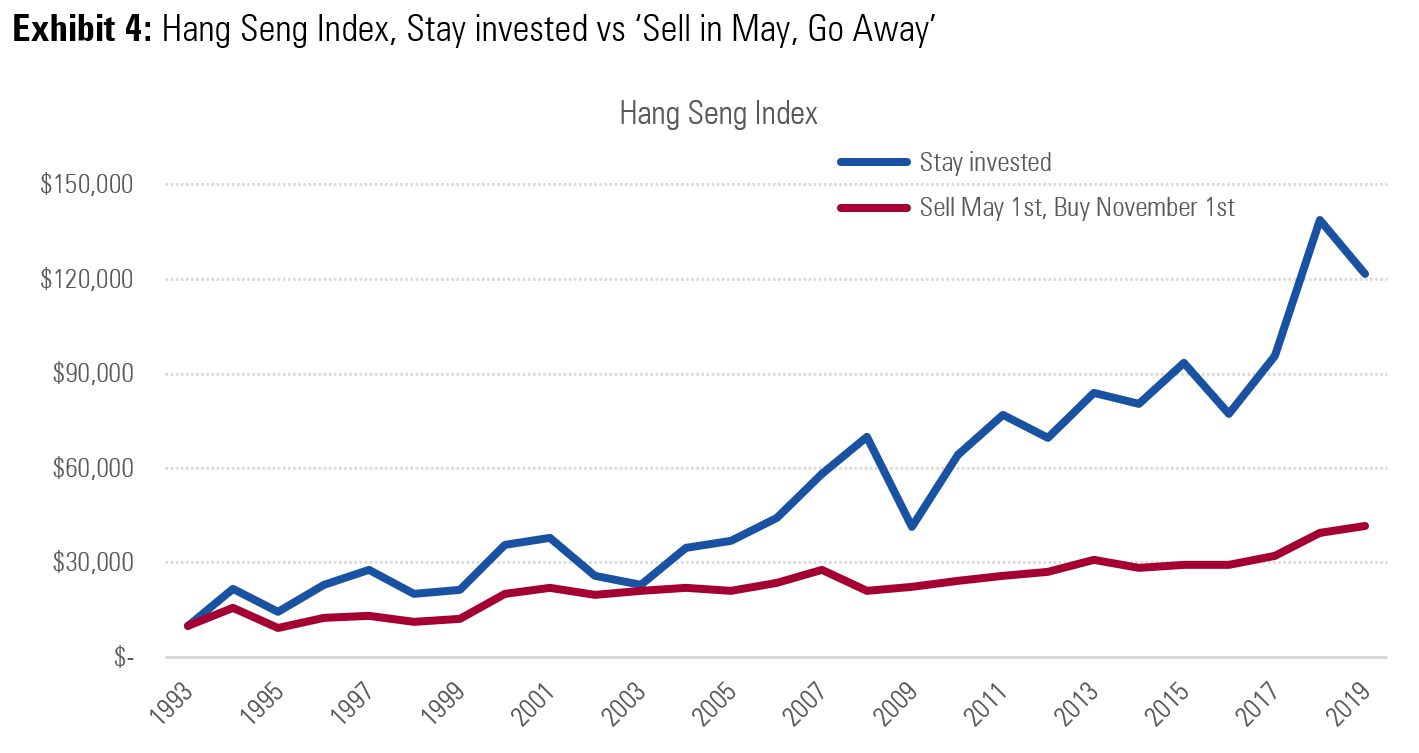

Data shows that cashing out every half year simply loses out over the long term. We’ve highlighted in blue the annual returns of the index, and in red the returns of the “Sell in May, Go Away” strategy. Though not a failure, it was found that most of the time, leaving the market in May and then returning in November affords a lower return than staying invested.

- source: Morningstar Direct, Author’s calculations.

The effect of stay invested is even more remarkable if investors are in the Hong Kong stock market. Investing in the city’s ‘blue chips’, large-cap constituents like CK Hutchison (then Cheung Kong Group) (00001), CLP (00002) and HSBC (00005), have accumulated the initial capital to HK$ 121,924. Portfolios that applied the “Sell in May, Go Away” strategy, they would find themselves with HK$80,000 less than someone who simply stayed invested the entire time.

Comparatively, the highly volatile MSCI China on a year-on-year basis vastly differs in its risk-return profile, earning HK$ 4654, or 46.5% return. Cashing out every six months would break the work of compounding in your portfolio -- a core financial concept that is imperative to the success of investors, which ended up oscillating around the HK$ 10,000 mark throughout almost three decades. The simulation of historical data concluded with only a HK$ 415 gain, which did not even include the trading cost and market slippage impacts that frequent selldowns would incur.

- source: Morningstar Direct, Author’s calculations.

All this said, investors need patience and nerves of steel to benefit from markets. Although it is very tempting to be drifted by social media hearsay or catchy slogans, timing the market rarely affords better returns. Technical analysis techniques have its place in betting against investor behavior, as it requires a great deal of attention and skill to execute consistently and success. As Ian Tam concluded: “The market is generally efficient, and investors can expect that any systemic opportunities are quickly arbitraged away by professionals. For retail investors, keeping true to risk tolerance and having a realistic expectation of returns will lead to a better path to financial success over the long term.”

This article does not constitute financial advice. It is always recommended to speak to an advisor or investment professional before investing.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

Alibaba Stock is Now Cheap

Alibaba Stock is Now Cheap

Naysayers Were Wrong About the 60/40 Portfolio. Here’s Why.

Naysayers Were Wrong About the 60/40 Portfolio. Here’s Why.

2023: The Best and Worst Stock Performers in Hong Kong

2023: The Best and Worst Stock Performers in Hong Kong

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

.png) 2025 Morningstar Fund Awards Winners

2025 Morningstar Fund Awards Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

Markets Brief: If Tesla Stock is Falling, Why Is It Still Expensive?

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends

.jpg)