‘Greenwashing’ is a process in which a company markets itself as environmentally sound, or claims to adhere to ESG (environmental, social and governance) factors, while not actually doing so. Greenwashing is basically misleading – for example, a company might try to convince its investors that it is environmentally friendly because it uses solar power in its offices, but may continue to pollute waterways by dumping chemicals into the ocean.

As Morningstar.com’s Director of Investor Education Karen Wallace points out, “Greenwashing affects consumers and investors alike. Companies that make false claims about the sustainability of their products profit from duping consumers who believe they are making an earth-friendly or socially conscious choice. Asset managers who claim to follow a sustainability-led mandate but invest in companies with significant ESG-related risk are doing their fund investors a similar disservice.”

It can be very difficult for investors to distinguish between genuine and effective ESG risk-mitigation efforts and greenwashing. Wallace also notes that there’s no question that subpar regulatory disclosure requirements have exacerbated the problem.

Enter ESG Risk Ratings

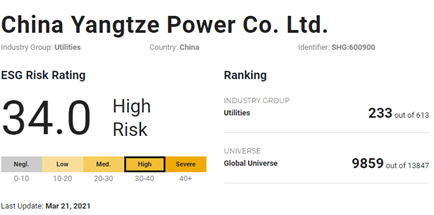

Sustainalytics’ ESG Risk Ratings can help investors measure the degree to which ESG issues are putting a company’s enterprise value at risk. The higher the ESG Risk Rating, the higher the company’s unmanaged ESG risk. (Sustainalytics, a Morningstar company, provides free access to ESG Risk Ratings on over 4,000 companies.)

An important characteristic of the ESG Risk Rating is that it is an absolute measure of risk. In other words, the scores and ratings are comparable across different issues, companies, and industries.

The rating is composed of two main parts: "Exposure" measures a company’s vulnerability or susceptibility to ESG risks. To a large degree, the industry a company operates in dictates the ESG risk it faces. For example, an oil and gas company will be highly exposed to environmental risk, while a consumer technology business will be more exposed to social issues, such as data privacy.

The "Management" dimension refers to actions taken by a company to manage a particular ESG issue. This can include a company’s ESG issues and policies. Controversies can negatively impact a company’s management score because they often reveal that management initiatives were insufficient or ineffective.

The ESG Risk Rating blends the exposure score and the management score together.

Here's a closer look at China Yangtze Power (600900):

- source: Sustainalytics.com

To be absolutely clear, we are not saying that China Yangtze Power is greenwashing. China Yangtze Power operates hydropower plants in Asia’s longest river Yangtze River, and takes a pivotal role in the country’s energy transition and the authority’s pledge of achieving carbon neutrality by 2060.

That said, operating renewables does not make a company immune to environmental risks. In owning and operating the Three Gorges Dam, the company exposes itself to some lasting concerns on landslides, a deterioration in water quality and a loss of biodiversity.

Other red flags were in the "S" and "G" parts of the ESG risk equation, with specific issues emerging from community relations and staff safety concerns. The project also stirred numerous controversies related to its social impact as it triggered massive floods and the resettlement of 1.3 million people in 2008, some of whom have allegedly not been compensated as promised. The company has also been implicated in the exceptionally high risk that the potential discharges to ease the flooding of the river Yangtze or the outright collapse of the dam that could endanger at-least 10 million residents in the immediate vicinity in the city of Wuhan and 400 million residents further downstream.

The robustness of board and management is also a key element when it comes to an ongoing evaluation of ESG risk mitigation. Sustainalytics analysts note that China Yangtze Power has no disclosed board-level oversight of relevant industry risks.

For more, Sustainalytics provides insights into the ESG risks of listed companies around the world. You can evaluate the potential shortfall in ESG issues and compare them with peers in the industry before investing.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

.png)

.jpg)