The menu of thematic funds has mushroomed in recent years. These funds attempt to harness secular growth themes ranging from artificial intelligence to cannabis. The result has been a steady supply of greater complexity from asset managers and increased demand for greater clarity among investors. In our recently issued report on the global thematic funds landscape, we introduced a novel taxonomy for classifying these funds. Here, with help from this framework, we will look at the global landscape in part 1 of this article. We’ll finish in part 2 by sharing best practices for choosing from this expansive universe.

Defining the Universe of Thematic Funds

We have defined the universe of thematic funds as those that select holdings based on their exposure to one or more investment themes. These themes may pertain to macroeconomic or structural trends that transcend the traditional business cycle. Examples include demographic shifts or technological advances.

Our definition includes funds like cannabis exchange-traded funds, which hope to capitalize on the legalization and commercialization of cannabis globally. We exclude funds that might be useful for making tactical economic calls but lack a cohesive longer-term narrative, such as those that target Japanese exporters.

Although many active managers select investments based on exposure to a theme as part of their investment process, we have isolated a distinct subset of funds that explicitly target these themes, be they actively managed or indexed. The purpose of this exercise is to identify and analyze these funds to help investors better navigate this landscape.

Mapping the Universe

To make sense of the diverse universe of thematic funds offered to investors around the world, we have developed a three-tiered taxonomy.

At first glance, it appears that thematic funds tend to resist rigid categorization. However, after assessing the global universe of these funds, we found that themes do cluster into distinct groups. For example, funds tracking Smart Car, Next-Generation Automobile, Hybrid Car, and Automated Driving themes can all be comfortably collected under the umbrella of Future Mobility--which, in turn, can be grouped with other themes under a broader theme, in this case Technology.

Our framework first arranges the universe into four broad buckets: Technology, Physical World, Social, and Broad Thematic.

Technological themes, as their name suggests, target the disruptive growth potential of technological change. These include popular themes like Fintech, Robotics and Automation, and Connectivity.

Physical World themes address the management of physical resources. Included in this bucket are funds that facilitate the transition to a low-carbon world, such as alternative energy funds.

Themes in the Social bucket deal with structural changes in society. These themes may be politically oriented or focus on demographic changes.

Finally, those funds that track multiple themes belonging to any of the above buckets are grouped under the Broad Thematic umbrella.

Analyzing the Universe

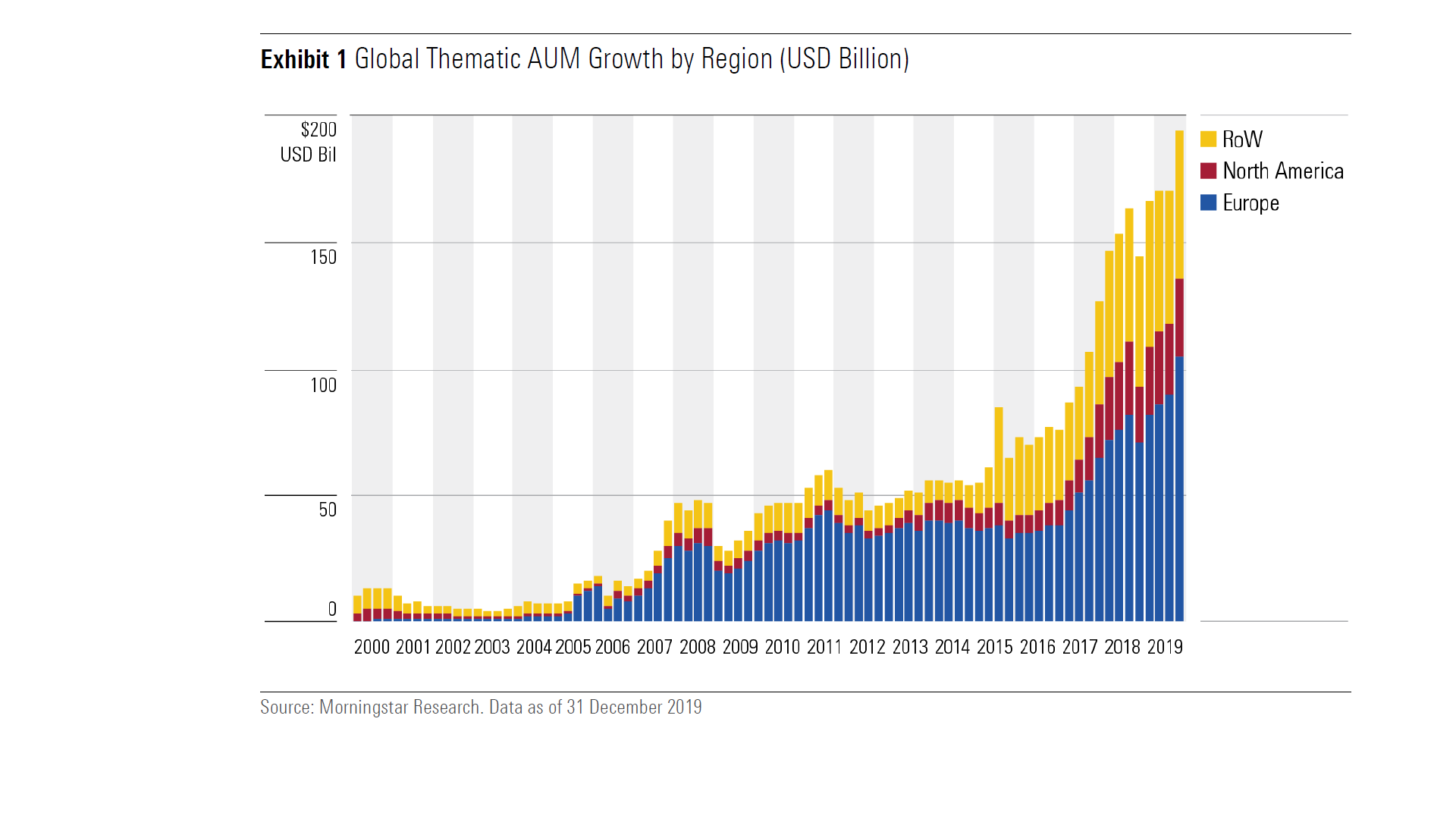

As of the end of December 2019, there were 923 funds in our global database that fit our definition of thematic. Over the trailing three years, collective assets under management in these funds grew nearly threefold, from US$75 billion to approximately US$195 billion worldwide. This represented approximately 1% of total global equity-fund assets, up from 0.1% 10 years ago.

The menu of thematic funds has mushroomed. A total of 154 new thematic funds debuted globally in 2019, falling just short of the record 169 new funds launched in 2018.

Thematic funds’ growth has been uneven across geographies. European-domiciled thematic funds' share of the global pie has expanded from 2% to 54% since the year 2000. Despite growing tenfold in size, the market share of thematic funds domiciled in North America decreased from 28% to 16% over the same period.

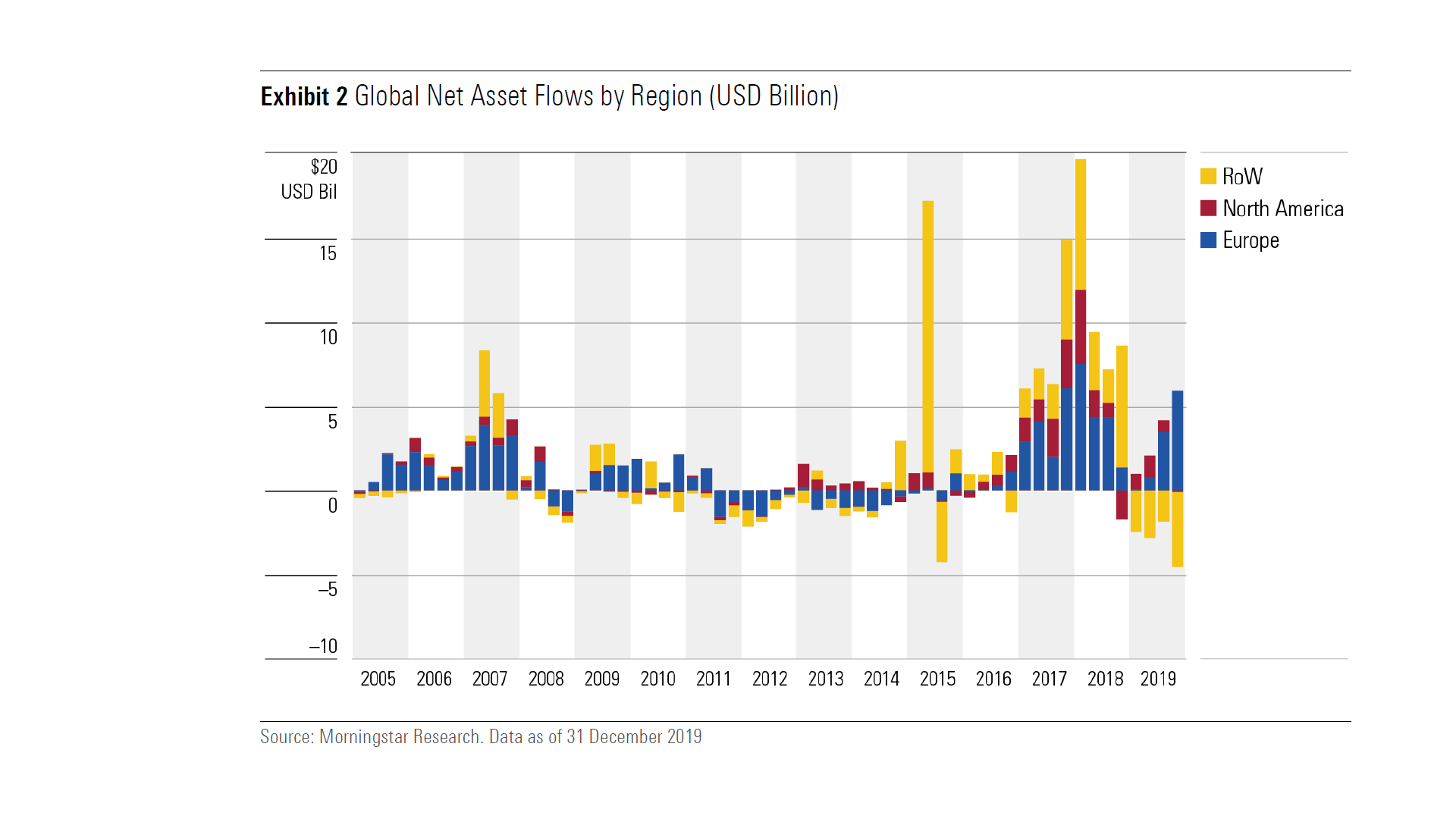

While all regions have experienced net inflows over the trailing five years, Europe and Rest of the World have been the main beneficiaries, netting US$45 billion and US$36 billion in new flows over the period, respectively.

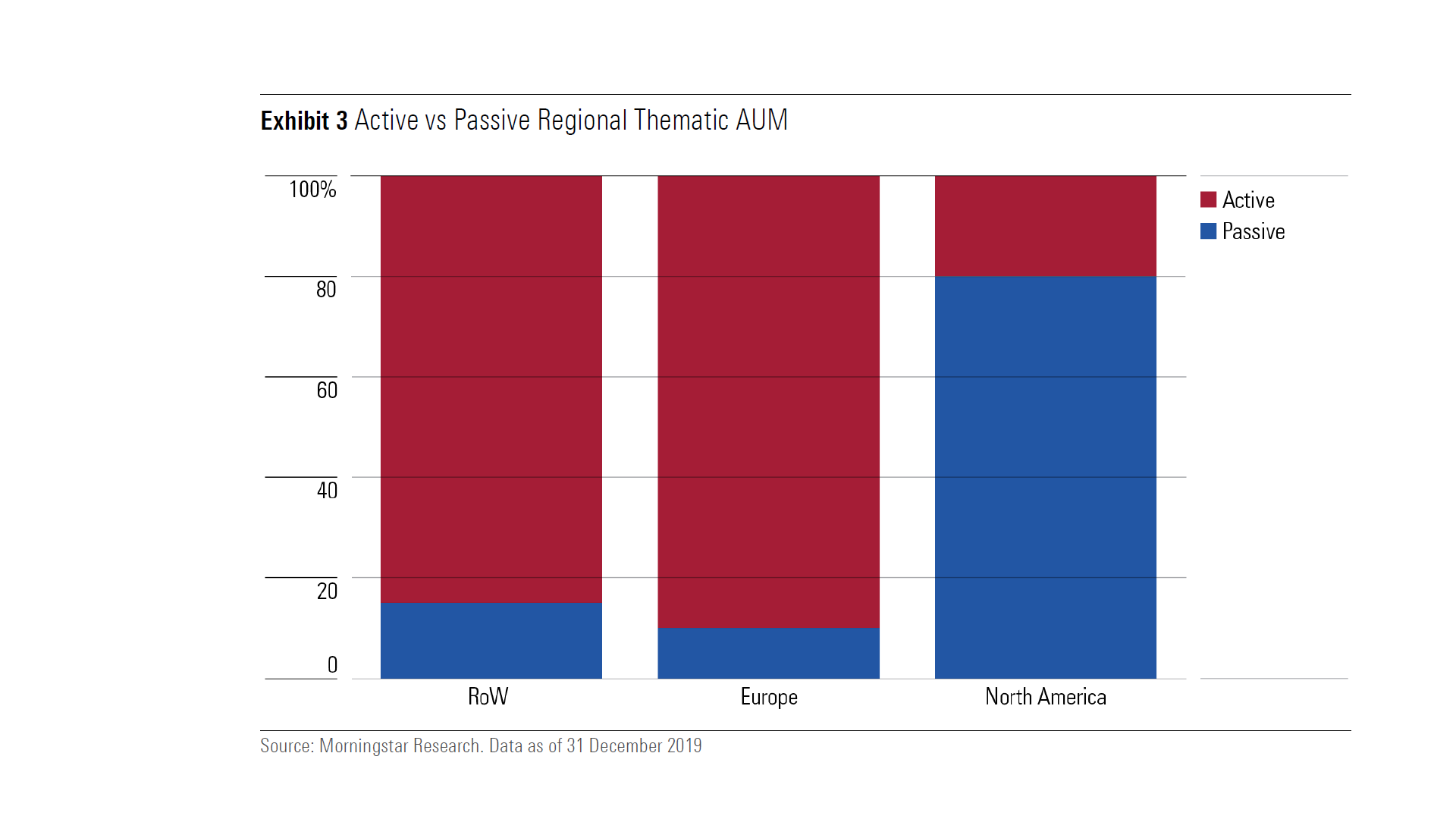

Most assets invested in thematic funds globally are actively managed, including more than 90% of assets under management in Europe. Bucking the trend is North America, where over 80% of thematic fund assets are passively managed. This reflects the success of thematic ETFs in the region.

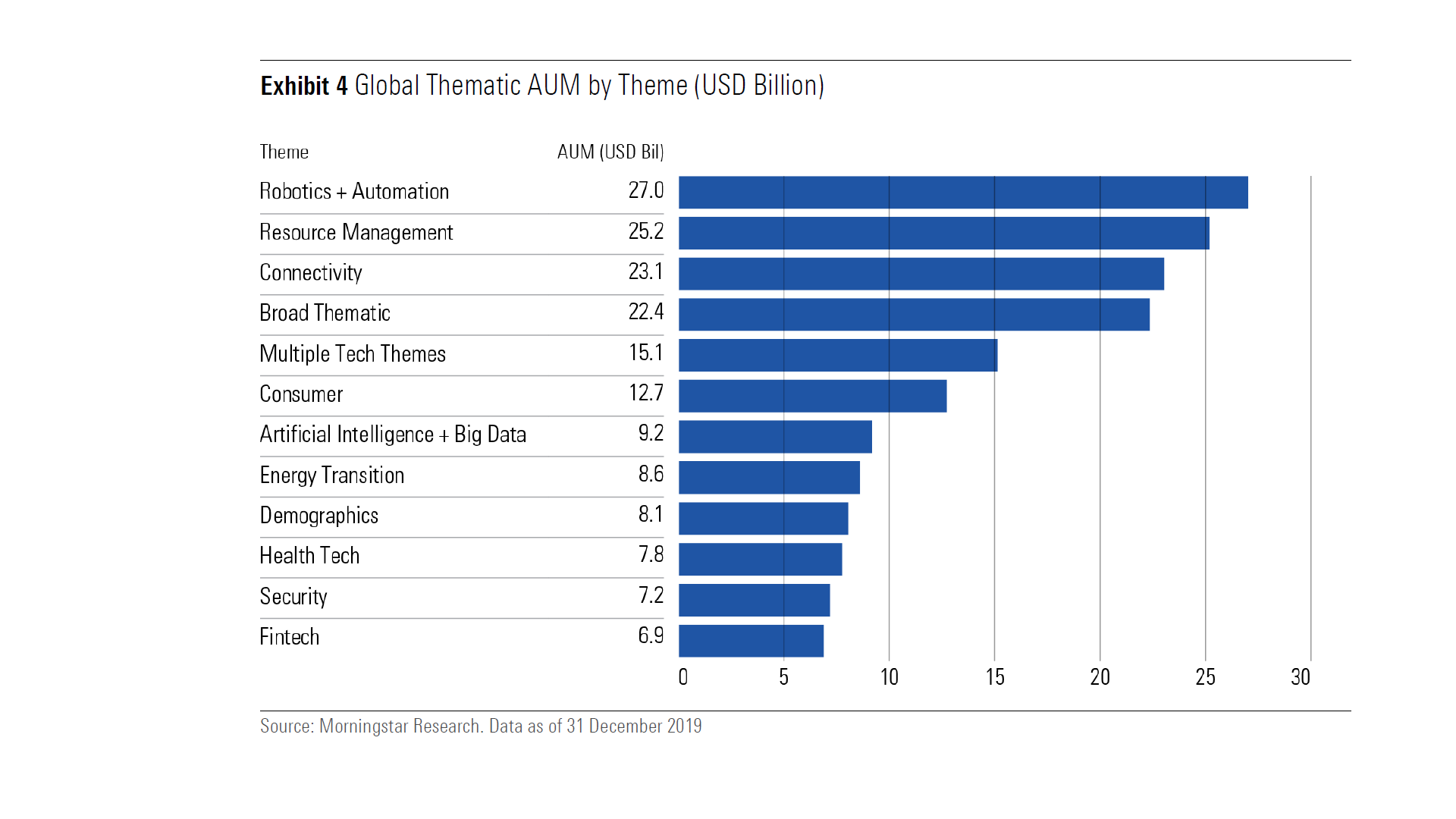

Technology is the most popular broad theme, hoarding half of assets in thematic funds globally. With over US$27 billion in assets, Robotics and Automation is the most popular theme globally.

Interestingly, North American funds account for just 6% of global Robotics and Automation assets, with the remainder divvied up 55%/45% between funds in Europe and Rest of the World.

Resource Management funds, a grouping largely populated by water-focused strategies snatches second place, with US$25 billion in assets under management.

The third step on the podium goes to funds with a connectivity theme. This grouping includes funds tracking themes focused on an increasingly connected world such as Smart Cities and Internet of Things.

.png)