All market indices, category averages and fund performances are quoted in HKD for comparison purposes.

Market Overview

The first quarter of 2014 was anything but peaceful. Here, we take a look at the major macro-economic events of the past quarter and how they have affected the performance of MPFs.

In the US, the S&P 500 returned a meagre 1.34% in the first quarter against a backdrop of escalating tension in Ukraine, severe weather conditions and softer economic data. Indicators such as a low labour force participation rate and lower-than-targeted inflation suggested that the US’ recovery may have slowed in recent months, contrary to the general optimism displayed at the end of last year. Nonetheless, the Federal Reserve stayed the course on tapering its quantitative easing program under the new leadership of Janet Yellen: the Fed has so far reduced its monthly asset purchases to US$55 billion a month from US$85 billion, as of April 2014.

Yellen said in March the Fed might raise interest rates about six months after it ends its massive bond-buying program (widely expected to take place towards the end of this year), which would be sooner than anticipated. However, yields on Treasuries fell during the quarter and with the US being a major bond market globally, the positive effect spilled over to the international fixed interest market. The Barclays Global Aggregate index rebounded from its 2.56% annual loss in 2013 and rose by 2.45% this quarter.

Concerns over slower economic growth in China intensified in Q1 of 2014. The official Purchasing Managers’ Index (PMI) slid to 50.3 in March 2014 from 51.0 in December 2013, indicating a slowdown in the manufacturing sector. Meanwhile, the HSBC/Markit PMI slipped to an eight-month low in March 2014, landing at 48.1. This marked a return to “contracting” territory as compared with December 2013’s 50.5. To combat the weakening economic expansion, the State Council announced in late March that China would speed up investment projects to ensure the economy meets its 7.5% growth target. The CSI 300 index dropped 10.28% for the quarter, which was partially attributable to the RMB’s weakness as the currency depreciated by 2.40% against the Hong Kong dollar over the quarter. Hong Kong’s Hang Seng index fell by 4.96%.

The Japanese economy rallied strongly in 2013 in reaction to “Abenomics”, which caused the yen to depreciate, raising the competitiveness of Japanese exporters. However, the exodus from emerging markets to Japan as a safe haven has led to the yen’s appreciation during the first quarter of 2014. Furthermore, there has been concern that the country’s sales tax hike to 8% from 5% in early April may threaten domestic consumption and undermine Japan’s recovery. The Nikkei 225 index fell 7.07% for the quarter.

MPF Performance

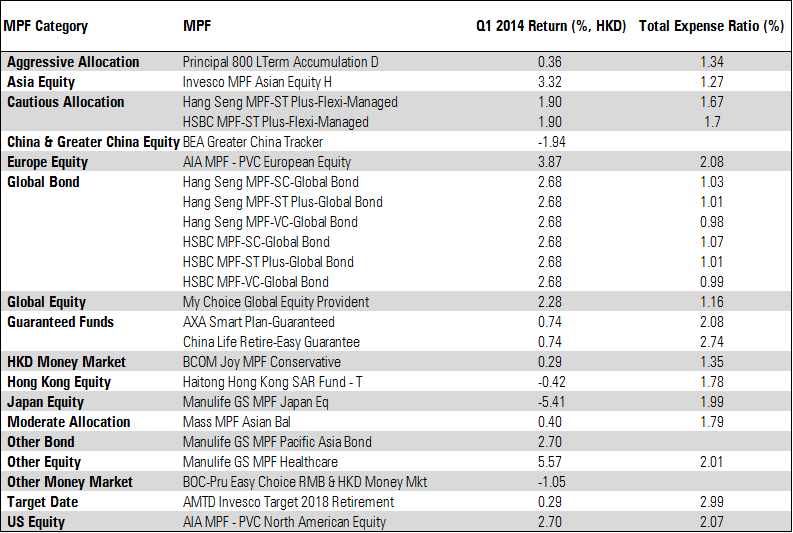

MPFs had a rather disappointing start to 2014, with most of our MPF categories posting absolute losses in the first quarter. Moreover, those that managed to stay afloat only delivered mediocre returns. The best performing MPF category this quarter was Europe Equity, which averaged a small gain of 2.22%. Within the category, AIA MPF - PVC European Equity was the winner, recording a quarterly return of 3.87%.

Closely following the Europe Equity category, Global Bond MPFs posted an average return of 1.54%, making it the next-strongest performing category. This was a big comeback from the category’s 2.56% annual loss in 2013. The Hang Seng and HSBC MPF Global Bond fund (available on their SimpleChoice, SuperTrust and ValueChoice schemes) led the pack by gaining 2.68%.

Despite the weak economic data and the Feb winding down its bond purchasing program, MPFs that predominantly invest in US equities managed to finish the first quarter in positive territory by a mere 0.99%. The best performer in the category was AIA MPF – PVC North American Equity, having delivered a 2.70% quarterly gain. This is not to say that all of the funds in the category did well; Mass MPF US Equity was at the bottom of its peers by being 0.55% in the red. That said, this fund was the top performer of the entire MPF universe in 2013, which highlights our belief that investors should not focus on short-term performance.

Hong Kong investors’ favourite MPF category – China and Greater China Equity – slumped by 5.20% on average, making it the second-worst performing category this quarter. Albeit being the category leader, BEA Greater China Tracker offered investors little consolation by being down 1.94%. The fund tracks the FTSE Greater China Index and thus has exposure to Taiwan, a market that fared relatively well this quarter. Similarly, Hong Kong Equity MPFs posted an average loss of 4.55%, with top performer Haitong Hong Kong SAR Fund – T down by 0.42% year-to-date.

Losing its strong momentum from the previous year, the worst performing MPF category by far was Japan Equity, having lost 8.15% on average. All Japanese equity funds have made a loss so far this year, with AIA MPF – BVC Japan Equity being the biggest loser of all the MPFs, suffering a hefty quarterly loss of 10.04%.

As always, we believe investors are best served by adhering to their long-term investment plans using a well-diversified portfolio and by avoiding being swayed by short-term changes in the macroeconomic environment. Furthermore, investors should never rely on simple performance data when making investment decisions. A key factor to consider is fees, as high fees will certainly erode an MPF’s future returns potential. Different MPFs bear different degrees of risk. For example, equity funds are generally riskier than bond funds and investors should select their MPFs according to their own risk appetite and tolerance.

Q1 2014 Best Performing MPFs by Category

To review the full Q1 2014 MPF Performance Report, please click here.

.png)