Winners of the Morningstar Fund Award are recognized as funds that have added the most value within context of a relevant peer group for investors over the past year and over the longer-term.

To help our readers better observe what makes a fund a winner fund, we sent out questionnaires to the winning fund teams earlier and asked them to shed lights on their team structure, how various risks have affected their investment decisions, and the major portfolio changes over last year, etc.

Category Winner: Best Global Equity Fund - MFS Meridian Global Equity A1 GBP

Key Stats

Inception Date: 2005 Sep26

Morningstar Rating (as of 2014-02-28):

Total Net Assets (Mil, as of 2014-02-28): 4,640.19 USD

Manager: David R. Mannheim / Roger M. Morley and management team

Manager Start Date: 1999 March12 / 2009 Oct1

M: Morningstar MFS: MFS Meridian Global Equity A1 GBP investment team

M: Could you highlight any major changes you made to the portfolio over the course of 2013? Were there any particular holding that drove the fund’s performance for the year?

MFS: Consistent with our long-term approach to investing, there were no significant changes to the portfolio in 2013. Given the diversified nature of the fund there was no single holding that drove performance for the year.

M: What is your economic outlook for 2014 specific to the markets you cover and how are you positioned to take advantage of opportunities and/or mitigate potential risks?

MFS: Financial markets have delivered their global economic forecast for 2014, and it is an optimistic one. The nearly 15% advance in world equity prices during the second half of 2013, the rise in bond yields (with the 10-year US Treasury hitting 3% in December) and the 28% plunge in gold prices last year have all provided a clear sign that investors expect global economic growth to gather momentum and inflation pressures to remain subdued this year. Interestingly, and perhaps not surprisingly, cable TV gurus and Wall Street pundits have generally formed a consensus around this view, leading investors to conclude that equities will continue to outperform fixed income in 2014.

At this point, we find little to dispute in the consensus outlook. The US economy appears to be gaining momentum: The labour market has shown steady improvement, and the housing market has largely recovered from the impact of the mid-2013 spike in mortgage rates. As long as the US Federal Reserve tapers its asset purchases slowly and low inflation can keep rate hike expectations at bay, long rates should behave well. In Europe, survey data points to uneven growth, while the outlook for the United Kingdom is brighter. Japan still needs to propose the serious structural reforms consistent with the third arrow of Abenomics, and we also need to be convinced that the fiscal offsets to the sales tax hike will work. In the meantime, easy money and the weaker yen remain supportive trends.

As for the markets, one of our key long-term themes has been that the combination of modest global growth, low inflation and accommodative monetary policy would continue to be a hospitable backdrop for risk assets. We are aware, however, that this positive outlook has been discounted in asset prices, as reflected in rising valuations, and any deviation from this improving growth and low inflation story will be the main driver of 2014 market movements — up or down — and market volatility.

We believe our continued focus on high-quality (sustainable, durable franchises, significant free cash flow, solid balance sheets and strong management teams) companies with sustainable above-average growth and returns, whose prospects are not reflected in their valuation, provides the fund the ability to take advantage of opportunities and mitigate potential risks.

M: How is your investment team organized? Have there been or do you anticipate any changes tothe investment team or structure over the course of the year? Do you anticipate adding to theteam in the near future?

MFS:

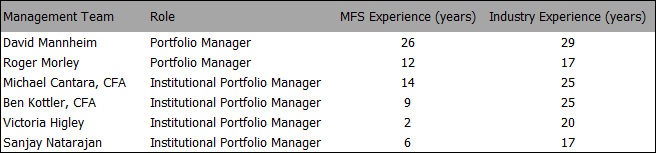

Portfolio Managers David Mannheim and Roger Morley have overall responsibility for portfolio construction, final buy and sell decisions, and risk management.

Institutional Portfolio Managers Michael Cantara, Victoria Higley, Ben Kottler, and Sanjay Natarajan take a leadership role in client communications, participate in the research process and strategy discussions, assess portfolio risk, customize separately managed portfolios to client objectives and guidelines, and manage daily cash flows.

There were no significant changes made to the Global Equity portfolio management team during 2013. However, effective from 31 March 2014, Michael Cantara will assume a new role as head of MFS' Global Client Group and transition his institutional portfolio management responsibilities to the remaining institutional portfolio managers listed above.

Global Research Platform

In managing Global Equity portfolios, the team has the benefit of drawing on the entire investment resources of the firm. Our fully integrated global research platform is the foundation of our investment process. We believe using a collaborative global structure to share and integrate information builds better insights for our clients. It allows us to look at viewpoints and opportunities from every angle and provides a global context to every decision.

As of 31 December 2013, the platform comprised 73 portfolio managers, 60 fundamental equity analysts, 24 fixed-income analysts, and 8 quantitative analysts who are based in Boston, Hong Kong, London, Mexico City, São Paulo, Singapore, Sydney, Tokyo, and Toronto. Additional resources included 30 investment and research associates.

Analysts are organized into eight global sector teams, which include fundamental equity and fixed-income analysts, quantitative analysts, and portfolio managers, that meet weekly on a formal basis. Each team, which is led by a sector leader, covers a major sector (capital goods, consumer cyclical, consumer staples, energy, financial services, health care, technology, and telecom) from a worldwide perspective. This organization facilitates the sharing of information on companies and industries across fundamental and quantitative disciplines, geographic regions of the world, asset classes and capital market structures. Our ability to leverage all of the proprietary research conducted by all of our analysts is a critical element in our ability to drive consistent long-term results for our clients.

We constantly monitor the asset growth of our client base in relation to the capacity of our investment management, research, and client service teams to ensure that we maintain the highest calibre of investment management services for each of our clients. We add staff, as needed, to avoid any possibility of compromising the quality of the investment products and services we provide.

Click here to see other winner features.