For the second year in a row, Morningstar has been recognized by the Institute of Financial Planners of Hong Kong (IFPHK), an organization of leading Hong Kong investment professionals, for achieving excellence in financial education.

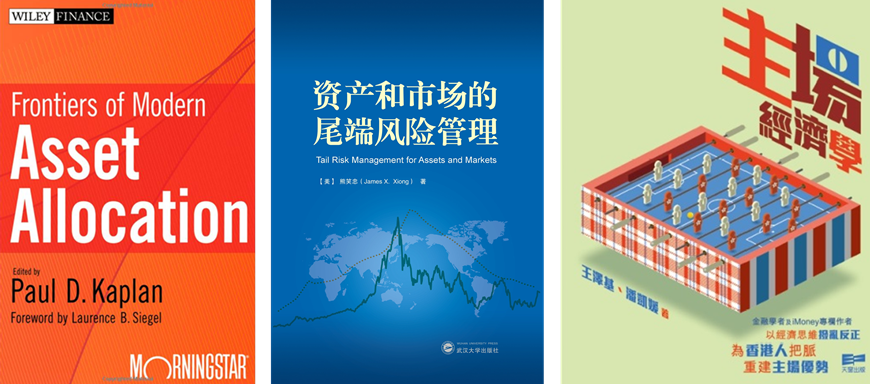

The IFPHK has named the book, Frontiers of Modern Asset Allocation, written by Morningstar research director Paul Kaplan, as its Adult Book of the Year for 2013. This latest award comes just one year after the group named Morningstar’s investment website as its 2012 Website of the Year.

In his book, published 2011, Morningstar’s Kaplan offers solutions to key challenges that investment professionals face when putting asset-allocation theory into practice. He addresses common issues such as:

- Should equities be divided into asset classes based on investment style, geography, or other factors?

- How do actively managed funds fit into asset-class mixes?

Morningstar continually publishes a wide range of investment education materials. The recently published, Tail Risk Management for Assets and Markets, written by Morningstar’s head of quantitative research, James Xiong, is one such example. Tail Risk Management examines numerous examples of past and present asset valuation bubbles in economies, stocks, and housing, among others. Xiong examines these phenomena using various conceptual frameworks, including classical economics as well as behavioral theories. Xiong applies various measures -- including probability distributions, statistics, and complex models -- to identify the “tail risk,” or probability of a “bubble bursting,” a term used to describe the risk of runaway asset valuations reverting to their mean by way of a sharp, sudden correction.

And then there is “Home” Economics released 2 months ago, co-authored by me and Dr. Chak Wong, Professor of Practice in Finance of The Chinese University of Hong Kong. In the book, we apply economics in everyday life: Are corporations necessarily evil just because they raise prices while making profits? If prices of all the Hong Kong properties double, while where you live and the size of your place remain unchanged, does your wealth or paper wealth increase? Wong holds a PhD in economics from Oxford University. He has formerly worked for Barclays, Goldman Sachs, UBS and other investment banks. Prior to joining Morningstar, I was a financial reporter and have co-authored a column with Wong for four years.

.png)